Imagine waking up on payday and seeing your entire salary hit your bank account—no deductions, no brackets to calculate, no April tax season stress.

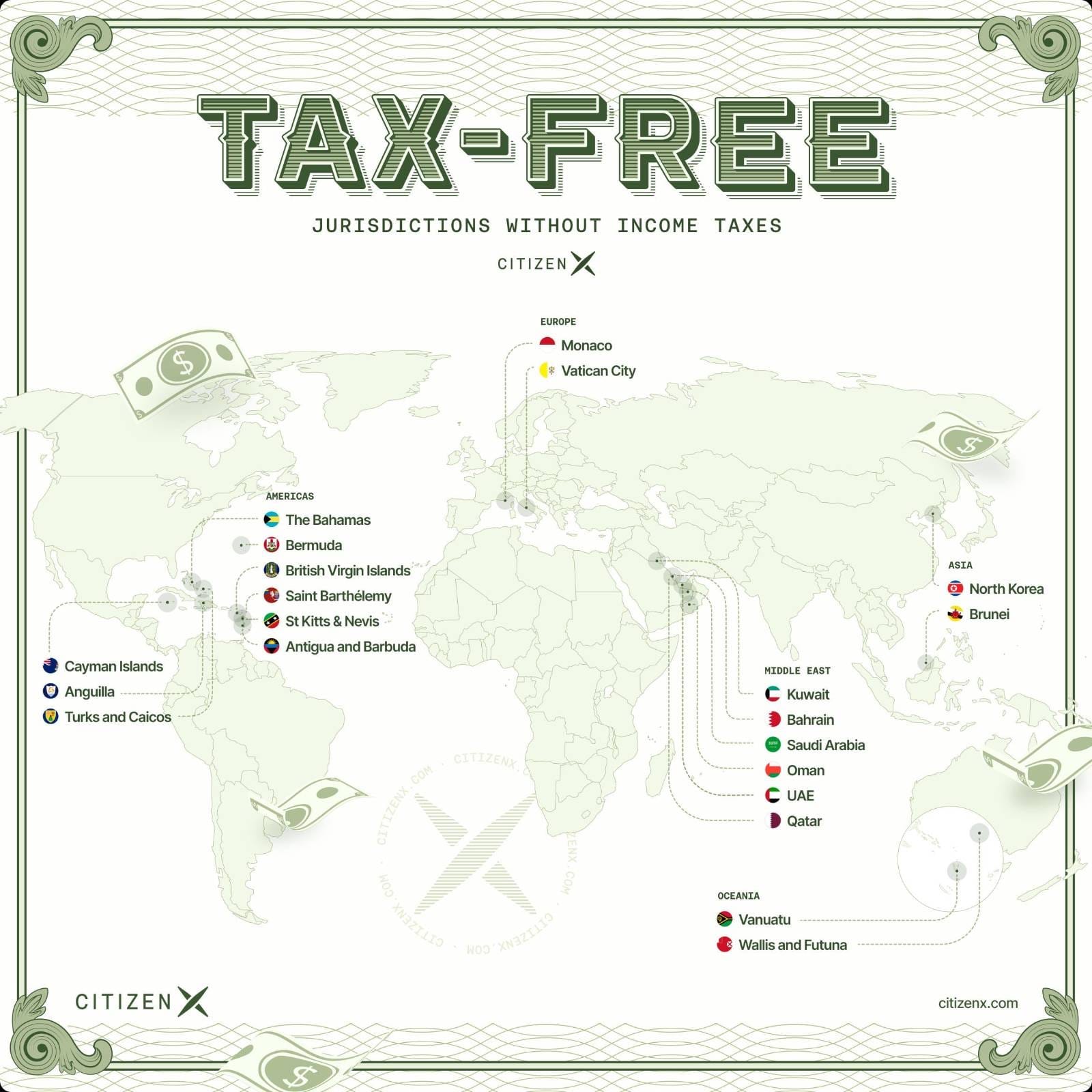

For residents of 21 nations around the world, this isn't a daydream but their financial reality. These income tax-free jurisdictions have created unique economic models that allow them to function without reaching into their citizens' pockets through personal income tax.

From sun-drenched Caribbean islands to oil-rich Gulf states, these tax havens have become magnets for high-net-worth individuals and expatriates seeking to maximize their earnings. While the idea of keeping 100% of your income sounds like a universal dream, these zero income tax locations come with their own sets of challenges, requirements, and economic trade-offs.

In this comprehensive guide, we'll explore which countries truly have no income tax, how they manage their economies without this revenue stream, and what it really takes to become a tax resident in these jurisdictions.

Whether you're considering international relocation or just curious about alternative tax systems around the world, this exploration of tax-free countries will illuminate one of the most intriguing aspects of global economic policy.

How Do Countries Without Income Tax Generate Revenue?

You might wonder: if a country doesn't collect income tax, how does it fund public services, infrastructure, and government operations? Tax-free countries have developed several alternative revenue models:

Natural Resource Wealth: Oil-rich Gulf states like the UAE, Qatar, and Kuwait fund their governments through petroleum exports. A small population relative to vast oil reserves allows these nations to operate with zero income tax while maintaining extensive public services.

Tourism and Financial Services: Caribbean tax havens like the Cayman Islands and the Bahamas rely heavily on tourism dollars and financial sector fees. By charging substantial customs duties, hotel taxes, and financial service levies, these island nations generate revenue without direct taxation of residents.

Value-Added Tax (VAT) and Consumption Taxes: Most tax-free countries implement some form of consumption tax. The UAE introduced a 5% VAT in 2018, while Monaco applies French VAT rates (currently 20%) to goods and services.

Corporate Taxation: Some countries with no personal income tax do selectively tax corporate profits. Bermuda, for instance, imposes a payroll tax on employers, while Monaco taxes companies that earn more than 25% of their turnover outside the principality.

Citizenship and Residency Programs: Nations like St. Kitts and Nevis generate substantial foreign income through citizenship-by-investment programs, where foreign nationals make a significant economic contribution in exchange for a passport.

This diverse approach to public finance allows these jurisdictions to maintain functioning economies and provide varying levels of public services without directly taxing personal income.

21 Countries and Territories with No Income Tax

The Americas

The Bahamas

The Bahamas stands as a classic Caribbean tax haven with no personal income tax, no capital gains tax, and no inheritance tax. Instead, the government funds itself through a 10% Value Added Tax (implemented in 2022, reduced from 12%), import duties, and fees from its robust tourism and offshore financial sectors.

For those seeking tax residency, the Bahamas offers a relatively straightforward path: purchase real estate valued at $750,000 or more to qualify for permanent residence. Higher investments (around $1.5 million) can expedite approval. This permanent residency requires maintaining a physical presence of at least 90 days annually.

The cost of living is moderate to high, especially in Nassau, but the trade-off includes beautiful beaches, a pleasant climate, and the complete absence of income taxation. Safety concerns exist in parts of Nassau, though most expatriates live in secure communities, and the outlying islands have much lower crime rates.

Recent changes include reducing VAT from 12% to 10% in 2022 and the formalization of the permanent residency by investment program in 2021, making the process more streamlined for wealthy investors.

Bermuda

Despite having no personal income tax, Bermuda imposes a payroll tax split between employers and employees (up to 8% for employees and 10%+ for employers). This British Overseas Territory funds its government through this payroll tax, import duties, and fees from its thriving offshore insurance and reinsurance sector.

Gaining residency requires significant investment. The Economic Investment Residential Certificate (EIRC) grants immediate indefinite residency upon investing $2.5 million in qualifying Bermudian assets. Certificate holders must maintain this investment for at least 5 years and spend a minimum of 90 days annually in Bermuda during this period.

Bermuda has one of the world's highest costs of living, with extremely expensive housing and imported goods. However, the quality of life is exceptional, featuring beautiful scenery, low crime rates, excellent infrastructure, and top-notch healthcare and education.

In 2023, Bermuda streamlined its investor residency program from a two-step process to the single EIRC, making it easier for wealthy individuals to gain long-term residency rights.

Cayman Islands

The Cayman Islands, famous for its zero income tax policy, thrives as a premier offshore financial center. Government revenue comes primarily from import duties (often 22-27%) and financial industry fees. With thousands of registered companies and investment funds, Cayman earns substantial licensing income instead of relying on personal or corporate taxation.

Residency options include a Permanent Residency Certificate by investing CI$2 million (approximately US$2.4 million) in developed real estate. This grants indefinite residence rights with a minimal presence requirement of just one day per year. After 5 years, this can lead to British Overseas Territory citizenship. Lower investment options include 25-year renewable residency with CI$1 million investment (half in real estate) plus showing annual income of CI$120,000.

The Cayman lifestyle comes at a premium—among the highest in the Caribbean—but offers excellent infrastructure, good healthcare, very low crime rates, and political stability as a British Overseas Territory.

Recent developments include the introduction of the Global Citizen Concierge Program in 2020 for remote workers and refined residency-by-investment rules.

British Virgin Islands

The BVI operates without personal income tax, primarily generating government revenue through its role as a premier offshore financial center. The territory charges incorporation fees and annual license fees for the hundreds of thousands of offshore companies registered there. It also collects a payroll tax on local employment (10-14% tax rate, split between employer and employee).

Historically, long-term residence was difficult to acquire without continuous employment. However, in January 2025, the BVI government announced plans to establish a Residency by Investment (RBI) program to attract investors who contribute to the local economy. While details on investment thresholds are still being finalized, this represents a new pathway for investors to gain residency status.

The cost of living is high due to the islands' remoteness and dependence on imports. Housing costs are substantial, especially around Road Town, Tortola. However, the quality of life includes world-class sailing, beautiful beaches, and exceptionally low crime rates in a politically stable environment.

The BVI's business environment heavily favors offshore financial services, with companies paying only flat annual fees rather than taxes on income or gains.

Anguilla

This small British Overseas Territory in the Caribbean imposes no personal tax on income. Instead, Anguilla funds itself through a 13% Goods and Services Tax (implemented in 2022), import duties, and financial services fees.

Anguilla offers the High Value Resident (HVR) Program, where foreign nationals can become tax residents by paying an annual fixed tax of US$75,000 and investing at least US$400,000 in local real estate. Participants must not spend more than 183 days in any other country to maintain their tax residency status. After 5 years of continuous residency, one becomes eligible for British Overseas Territory Citizenship.

The lifestyle includes tranquil island living with beautiful beaches, low crime rates, and a peaceful environment, though at a high cost of living due to imported goods and the new 13% GST.

Anguilla's tax incentives include the absence of property tax and the ability for HVR residents to lock in a flat $75,000 tax regardless of worldwide income.

St. Kitts and Nevis

Saint Kitts and Nevis operates without personal income tax, funding its government through tourism, a 17% Value-Added Tax rate, import duties, and its successful Citizenship by Investment (CBI) program—the oldest in the world (established 1984).

Unlike most tax-free jurisdictions, St. Kitts offers direct citizenship through investment without any residency requirement. The main options include a government fund donation (usually $150,000 for a single applicant) or a real estate investment (starting around $200,000-$400,000). Upon approval, investors and their families become citizens with full rights and a passport allowing visa-free travel to many countries.

The cost of living is moderate by Caribbean standards, cheaper than Bermuda or the Cayman Islands but more expensive than larger mainland countries. The quality of life features laid-back island living with good restaurants, historical sites, and decent infrastructure, though healthcare facilities are limited.

Recent changes include stricter due diligence processes for the CBI program implemented in 2023 and the introduction of a residency certificate program for foreigners who live in St. Kitts at least 60 days annually and pay a US$37,500 fee.

Antigua and Barbuda

As another no-income-tax Caribbean destination, Antigua and Barbuda relies on tourism, customs duties, and its Citizenship by Investment Program. The nation offers citizenship for a $100,000 donation to its development fund or a $200,000 real estate investment (held for 5 years).

Residents enjoy beautiful beaches, a growing yacht tourism industry, and relatively good infrastructure for the region. The nation maintains close ties to the United Kingdom as a Commonwealth member, providing political stability.

Turks and Caicos

Turks and Caicos imposes no personal income tax, instead generating revenue through customs duties, tourism taxes, and stamp duties on real estate transactions. Luxury tourism, especially on Providenciales ("Provo"), drives the economy.

The Permanent Residence Certificate (PRC) by Investment program typically requires a minimum of $1,000,000 in property on Providenciales or $300,000 on other islands. Alternatively, investing $1.5 million in a business on Provo qualifies for PRC. These investments come with a $25,000 fee for certificate issuance.

The cost of living is high, particularly on Providenciales, where most expatriates reside. However, the quality of life includes some of the world's best beaches, a relaxed pace, luxury dining, and low crime rates.

Recent developments include adjustments to residency regulations, raising some investment minimums to ensure only substantial investors receive residency status.

Saint Barthélemy

This French overseas collectivity maintains a no personal income tax policy, a legacy from its days as a free port. St. Barthélemy funds itself through customs duties, local sales taxes, and fees from high-end tourism.

To benefit from the tax-free status, one must actually live in St. Barthélemy for at least 5 years. French nationals specifically need to reside there for 5 consecutive years to be considered domiciled and thus exempt from French taxes.

St. Barthélemy has an extremely high cost of living—one of the highest in the Caribbean. The island caters to the ultra-wealthy with limited land and astronomical housing prices. However, quality of life is exceptional for those who can afford it, featuring pristine beaches, virtually no crime, and an exclusive environment.

Middle East countries

United Arab Emirates (UAE)

The UAE stands as a modern example of a country with no personal income tax, primarily funding its government through oil and gas revenues. In recent years, the UAE has introduced some indirect taxes: a 5% Value Added Tax rate implemented in 2018 and excise taxes on specific goods.

Residency options have expanded significantly. The UAE now offers:

- Golden Visas: 10-year renewable visas for investors, entrepreneurs, and skilled professionals

- Property Investment: Investing AED 2 million (~$545,000) in real estate qualifies for a 10-year Golden Visa

- Business Establishment: Setting up a company in a free zone can sponsor residence visas

- Retirement Visa: 5-year visa for those over 55 meeting financial criteria

- Remote Work Visa: 1-year visa for remote workers with sufficient income

While the UAE historically did not grant citizenship to expatriates, in 2021 it announced a policy to grant citizenship to select foreigners with exceptional talents by nomination of UAE royals or officials.

The cost of living varies widely, with Dubai and Abu Dhabi comparable to major Western cities. However, quality of life is generally very high with excellent infrastructure, world-class amenities, and extremely low crime rates.

A significant recent change: while personal income remains untaxed, the UAE introduced a 9% federal corporate tax effective from June 2023 on business profits above AED 375,000 (~$100,000).

Saudi Arabia

Saudi Arabia maintains a zero personal income tax policy for both citizens and expatriates, relying on its vast oil reserves to fund government operations. The kingdom introduced a 15% VAT in 2020 (increased from 5%) to diversify revenue streams.

Residency is typically obtained through employment, with expats requiring company sponsorship. Saudi Arabia has recently introduced a Premium Residency program (permanent residency) with two options: a one-time payment of SAR 800,000 (~$213,000) or an annual fee of SAR 100,000 (~$27,000).

The quality of life has improved with recent social reforms, though cultural restrictions remain compared to neighboring UAE. Infrastructure is modern in major cities, and crime rates are very low.

Qatar

This small, wealthy Gulf state levies no income tax on residents, funding itself through natural gas exports—Qatar possesses the world's third-largest natural gas reserves. The nation implemented a 5% VAT in 2021.

Residency typically requires employment sponsorship, but Qatar also offers property-based residency for those investing at least QAR 3.5 million (~$961,000) in real estate.

Living costs are high, especially for housing in Doha, but residents enjoy excellent infrastructure, high safety standards, and access to world-class healthcare and education.

Oman

Oman maintains no personal income tax regime, though it introduced a 5% VAT in 2021. The sultanate relies on oil revenues but has been diversifying its economy through tourism and manufacturing.

Expatriates typically gain residency through employment. However, Oman also offers an Investor Visa for those who establish businesses or invest in property valued at OMR 500,000 (~$1.3 million).

The cost of living is moderate compared to other Gulf states, while quality of life features traditional Omani hospitality, beautiful landscapes, and low crime rates.

Kuwait

Kuwait funds its no-income-tax policy through its substantial oil wealth. The country has repeatedly delayed the implementation of VAT, unlike its Gulf neighbors.

Residency is almost exclusively through employment sponsorship, with very limited options for investors or retirees. The country maintains strict immigration policies.

Living costs are moderate to high, with subsidized utilities and fuel. Quality of life offers modern amenities and infrastructure, though social activities are more limited than in Dubai or Doha.

Bahrain

Bahrain operates without personal income tax, relying on oil revenues, financial services, and a 10% VAT introduced in 2019. The island kingdom offers various residency pathways, including a Self-Sponsorship Residence Permit for investors purchasing property valued at BHD 50,000 (~$132,000) or more.

The cost of living is moderate for the Gulf region, while quality of life benefits from Bahrain's relatively liberal social policies, modern infrastructure, and strong expatriate community.

European countries

Monaco

Monaco, the tiny principality on the French Riviera, has maintained its no personal income tax policy since 1869. Instead, it funds itself through VAT (currently 20%, matching French rates), corporate income tax on companies earning more than 25% of turnover outside Monaco, and revenue from state-owned enterprises like the Monte Carlo Casino.

Becoming a resident requires securing accommodation in Monaco (buying or renting), opening a Monaco bank account with at least €500,000, and proving sufficient wealth to support yourself. Initial residency cards are temporary (1 year, renewable), eventually leading to 3-year and then 10-year cards.

Important exception: French citizens residing in Monaco remain subject to French income tax under a bilateral treaty.

Monaco's cost of living ranks among the world's highest, particularly for real estate, which can cost tens of thousands of euros per square meter. However, the quality of life is exceptional, featuring impeccable safety, excellent services, Mediterranean climate, and access to world-class healthcare and education.

Recent changes include Monaco signing onto the OECD's Automatic Exchange of Financial Account Information in 2018, ending the era of absolute banking secrecy.

Vatican City

The world's smallest sovereign state has no income tax system. The Vatican operates at the heart of Europe primarily on donations, museum revenues, and investment income. Residency is extremely limited, typically granted only to those working for the Holy See or related religious institutions.

Asia region

Brunei

This small oil-rich sultanate in Southeast Asia imposes no personal income tax on residents. Brunei's government is funded primarily through oil and gas exports, with the state-owned Brunei Shell Petroleum providing the bulk of government income.

Residency in Brunei is very restrictive. There is no formal investor visa, and even long-term residents often remain in permanent resident status rather than gaining citizenship. Most foreigners in Brunei are on work permits requiring employer sponsorship.

The cost of living is relatively low to moderate, with subsidized fuel and utilities. Quality of life features very low crime rates, good infrastructure, and modern amenities, though with conservative Islamic social policies that limit entertainment options.

North Korea

North Korea officially abolished taxes in 1974, declaring that a socialist state funded by the people's labor had no need for taxation. However, the absence of formal taxation masks a system where the state controls most economic activity and extracts resources through other means, including forced labor contributions.

For practical purposes, North Korea is not open to voluntary immigration, making it impossible for foreigners to become residents to benefit from the no-tax policy.

Oceania

Vanuatu

This South Pacific island nation operates without income tax, corporate tax, capital gains tax, or inheritance tax. Instead, Vanuatu relies on VAT, import duties, and its Citizenship by Investment programs.

The Vanuatu Development Support Program offers citizenship for a contribution of approximately $130,000 for a single applicant. Once citizenship is obtained, there are no residency requirements to maintain it.

The cost of living is moderate, while quality of life features beautiful tropical scenery, a relaxed pace, and a blend of Melanesian culture with French and British influences.

Wallis and Futuna

This small French overseas territory in the South Pacific imposes no income tax on residents. It relies on financial support from France and limited local revenue streams. Residency options are extremely limited for non-French citizens.

5 Benefits of Living in a Tax-Free Country

The most obvious benefit of residing in a tax-free country is keeping 100% of your earned income without having to pay income taxes. For high-net-worth individuals, this can translate to enormous savings, potentially millions of dollars annually depending on previous tax obligations.

Beyond the direct financial advantage, these jurisdictions typically offer:

- Asset Protection: Many tax-free countries provide strong privacy protections and legal structures for preserving wealth.

- Simplified Financial Planning: Without complex tax codes to navigate, financial planning becomes more straightforward.

- Potential Lifestyle Improvements: Many tax-free jurisdictions offer excellent weather, beautiful surroundings, and high standards of living.

- Estate Planning Advantages: Countries without inheritance or estate taxes make generational wealth transfer more efficient.

- Business Opportunities: Several tax-free countries have developed robust financial services sectors catering to international clients.

Challenges of Living in a Tax-Free Country

Living without income tax isn't without complications:

High Cost of Living: Many tax-free jurisdictions have extremely high housing costs and expensive daily expenses. Monaco, the Cayman Islands, and the UAE's prime areas feature some of the world's most expensive real estate.

Residency Requirements: Most low tax countries have significant investment thresholds or physical presence requirements to qualify for tax residency.

Limited Social Services: Some tax-free jurisdictions might offer fewer public services than high-tax countries with social security systems, requiring residents to pay out-of-pocket for healthcare, education, and other needs.

Home Country Tax Obligations: US citizens, notably, remain subject to worldwide tax liabilities regardless of residency, requiring compliance with US tax laws even when living abroad.

Potential Political Instability: Some tax-free jurisdictions may have different political systems or stability profiles than Western democracies.

Social and Cultural Adjustment: Relocating to a different country inevitably requires adaptation to new cultures, languages, and social norms.

Should You Move to a Tax-Free Country?

The decision to relocate for tax purposes should consider more than just the financial equation. Ask yourself:

- Can you meet the investment or income requirements for your preferred destination?

- Are you prepared for the lifestyle changes and potential cultural adjustments?

- Do you need to maintain ties with your home country for family, business, or personal reasons?

- How will the move impact your existing tax obligations, especially if you're a US citizen?

- Is the climate and environment suitable for your long-term happiness?

For many, a comprehensive wealth strategy might involve establishing residency in a tax-friendly jurisdiction while maintaining flexibility to travel and spend time in multiple locations. This approach requires careful planning with international tax experts to ensure compliance across all relevant jurisdictions.

Citizenship-based taxation: How to optimize taxes with a second passport

For citizens of countries that impose worldwide taxation based on citizenship (most notably the United States), simply moving abroad doesn't eliminate tax obligations. However, strategic planning with second citizenship can create opportunities for tax optimization.

Non-US citizens might consider obtaining citizenship in a country that:

- Does not tax worldwide income

- Has favorable tax treaties with countries where you have financial interests

- Provides visa-free access to regions where you conduct business

Americans face the unique challenge of citizenship-based taxation, with only two options for complete exit from the US tax system: renouncing citizenship (an irrevocable and increasingly expensive process) or structured tax planning that satisfies US reporting requirements while minimizing double taxation.

A second passport from St. Kitts and Nevis, Vanuatu, or other citizenship-by-investment programs can provide insurance against political instability and expanded global access, even if it doesn't immediately reduce tax obligations for Americans.

Final thoughts

The 21 countries and territories that operate without personal income tax present fascinating alternatives to traditional tax systems. From Caribbean islands to Middle Eastern kingdoms, each has developed unique methods to fund government operations while attracting wealthy residents and businesses.

While the prospect of zero income tax rate is undeniably appealing, the decision to relocate requires careful consideration of investment requirements, lifestyle factors, and ongoing obligations to your home country. For high-net-worth individuals with location flexibility, establishing tax residency in these jurisdictions can form a central component of a comprehensive wealth preservation strategy.

As global tax regimes continue to evolve with increased information sharing and transparency requirements, working with qualified international tax advisors becomes essential for anyone considering a move to these tax-free jurisdictions. The potential benefits are substantial, but so too are the complexities of international tax planning.

The best tax-free country for any individual ultimately depends on their unique circumstances, preferences, and long-term objectives—balancing financial advantages with quality of life considerations in an increasingly interconnected world.