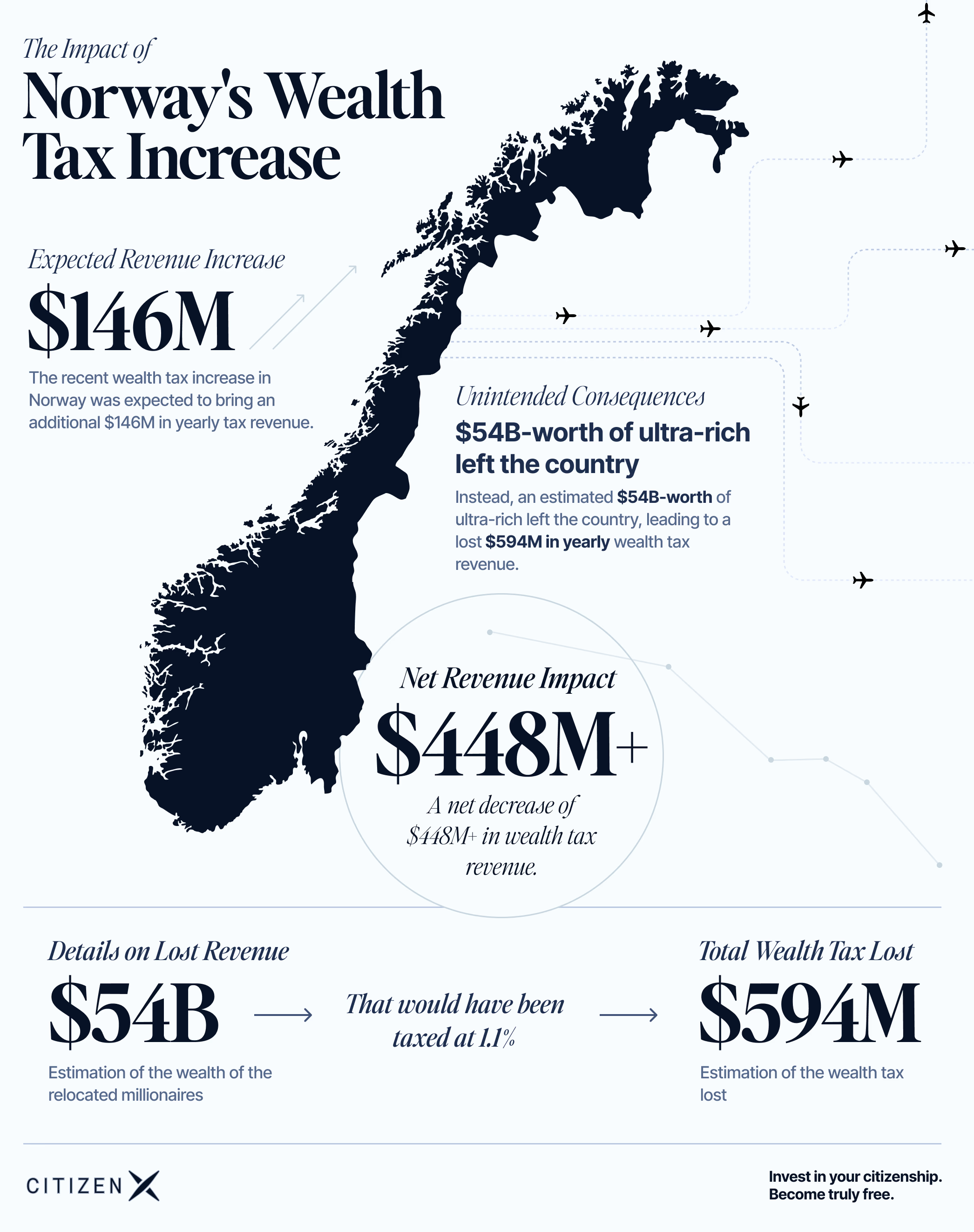

The recent wealth tax increase in Norway was expected to bring in an additional $146M in yearly tax revenue.

Instead, individuals worth $54B left the country, leading to a lost $594M in yearly wealth tax revenue.

That's a net decrease of $448M+.

The mass departure of Norway's billionaires has transformed into an unprecedented exodus, as the nation's tax administration grapples with one of Europe's most demanding wealth tax and income tax rates. Last year marked a watershed moment in this capital flight, with more than NOK 600 billion in assets leaving the country as high-net-worth individuals increasingly opted for tax havens over their homeland.

The phenomenon has caught the attention of global media, with The Guardian and other outlets documenting the steady stream of super-rich Norwegians seeking refuge in more financially hospitable jurisdictions.

Some of these individuals also explore structured mobility routes such as El Salvador Citizenship by Investment, which can complement tax relocation strategies with residency security.

🇳🇴 The recent wealth tax increase in Norway was expected to bring an additional $146M in yearly tax revenue.

— CitizenX (@CitizenX) June 3, 2024

Instead, individuals worth $54B left the country, leading to a lost $594M in yearly wealth tax revenue.

A net decrease of $448M+ ↓ pic.twitter.com/9KTndm2BtZ

The architecture of the extensive Norwegian taxation system

Norway's approach to wealth taxation reflects a sophisticated yet burdensome system that interweaves multiple fiscal obligations.

Each municipality wields authority to levy its own tax rates, while the national government imposes additional charges on personal income, net worth, and various forms of capital.

The current structure encompasses property tax, value added tax, and capital gains tax, creating a comprehensive framework that has prompted many of the nation's wealthiest citizens to reconsider their residency.

The Wealth Tax Burden

The net wealth tax stands at the heart of this controversy. Unlike most OECD countries, which have abandoned such measures, Norway maintains a stringent wealth taxation system. While certain exemptions exist for business assets, the overall burden falls heavily on those with significant net worth.

The valuation of assets for tax purposes, particularly real estate holdings, frequently generates friction between taxpayers and the tax administration, as disagreements arise over assessment methods and fair market determinations.

The Flight of Capital

Norwegian entrepreneurs and billionaires face particularly galling challenges under this tax regime.

The wealth tax rate, combined with dividend tax, often forces business owners to withdraw substantial funds from their companies solely to meet tax obligations. This creates a destructive cycle that hampers business growth and reduces incentives for domestic investment.

The situation becomes even more complex when you consider the exit tax regulations, which insidiously attempt to capture value from departing residents.

Consider the case of one prominent industrialist who faced an annual tax bill of NOK 175 million despite drawing a relatively modest salary from his business operations.

Such disparities between paper wealth and liquid assets have driven many wealthy Norwegians to seek alternatives abroad, with Switzerland emerging as a preferred destination.

The European Context

The contrast with neighboring countries is notable. Not every EU and EU-adjacent country is taking the same approach as Norway and France.

Sweden, once renowned for its high wealth taxes, abandoned such levies years ago, recognizing their potential to drive away capital and talent. Finland and Denmark have similarly opted for different approaches to taxing their wealthy citizens.

Spain remains one of the few European nations maintaining a wealth tax, though its system offers more flexibility through regional variations and exemptions.

The Swiss Alternative

Switzerland's cantons have become particularly attractive to Norway's departing wealthy.

With its favorable tax base and various cantonal incentives, Swiss municipalities offer attractive alternatives to Norway's rigid system.

Cities like Lucerne actively court Norwegian expatriates, creating communities of former Nordic residents who share similar tax-driven motivations for relocation. The absence of inheritance tax in many Swiss regions provides an additional draw for family businesses considering relocation.

Real Estate and Asset Valuation

The treatment of real estate under Norway's wealth tax system presents particular challenges. Property valuations can vary significantly between tax assessment and market value, creating additional complexity for wealthy individuals with substantial real estate holdings.

This disparity affects both residential and commercial property owners, often forcing them to maintain higher cash reserves solely for tax purposes.

Economic Impact and Policy Response

The Norwegian tax administration faces difficult choices as it watches its tax base erode. While property tax and value added tax provide stable revenue streams, the exodus of billionaires threatens significant portions of the government's income.

Recent estimates suggest that departing wealthy individuals control combined fortunes of at least NOK 600 billion - capital that now resides beyond Norway's borders.

Exit Tax Considerations

The government's response has largely focused on tightening exit tax regulations rather than addressing the underlying causes of departure.

New provisions require departing residents to pay taxes on unrealized gains, with payment periods extending up to twelve years. This approach risks accelerating the exodus as wealthy individuals rush to relocate before new restrictions take effect. Austria, another European nation grappling with similar challenges, watches Norway's experience closely as it considers its own wealth tax policies.

The global context and Future Implications

In the broader context of international tax competition, Norway's experience offers crucial lessons about the limits of national tax sovereignty in an era of mobile capital.

While some European nations maintain certain wealth-linked taxes, most have moved toward more flexible systems that acknowledge the reality of global competition for high-net-worth individuals and their investments.

The pressure from tax havens and the mobility of modern capital pose existential challenges to conventional tax policies.

This dynamic particularly affects countries with high wealth tax rates, as they compete not only with traditional low-tax jurisdictions but also with nations offering specialized incentives for wealthy immigrants.

This is why obtaining second citizenship and multiple passports is a crucial diversification strategy in the modern world. Many investors are exploring options like Citizenship by Investment in Argentina to add geographic and legal flexibility to their planning.

Social Implications and Public Debate

The exodus has sparked intense public discourse about social equity and economic incentives. Each tax return season brings fresh reminders of wealthy departures, while policy makers search for ways to maintain public services without driving away the very taxpayers who contribute most to their funding.

Norway’s Wealth Tax and the Founder Exodus@Jason, @alex and @Dune CEO Fredrik Haga discuss how Norway’s wealth tax on unrealized gains is forcing many founders to leave the country, as the policy creates overwhelming financial burdens for startups.

— This Week in Startups (@twistartups) November 26, 2024

• The Tax Burden: Norway's… pic.twitter.com/h0zkIllAPw

Supporters of the current system argue that wealth taxes play a crucial role in maintaining Norway's social democratic model.

Critics counter that driving away successful entrepreneurs ultimately undermines the tax base needed to support social programs.

This debate extends beyond simple fiscal considerations to fundamental questions about the nature of social contracts in an age of global mobility.

Looking Forward

As Norway grapples with these challenges, its experience resonates far beyond its borders. Other OECD countries watch developments closely, recognizing that Norway's wealth tax experiment may shape global tax policy discussions for years to come.

With billions of NOK in assets already relocated and more wealthy individuals considering departure, the pressure for reform continues to mount.

The story of Norway's wealth tax thus represents more than a simple tale of tax rates and capital flight. It embodies fundamental questions about the survival of progressive taxation in a world where capital moves freely across borders.

As the exodus continues, these questions become increasingly urgent, not just for Norway but for all nations seeking to fund robust social services while remaining attractive to mobile wealth and talent.