My presentation at the Bitcoin 2024 conference in Nashville now feels more relevant than ever, so I thought I would make it available to everyone here.

Full presentation

Notes

In the decade since Bitcoin's emergence, we've witnessed a profound transformation in how people think about money, sovereignty, and freedom. Bitcoin has unleashed unprecedented financial sovereignty, creating a truly independent monetary system.

Yet a crucial irony remains: while our money has been liberated from fiat-based paradigms, our freedom of movement remains shackled by traditional citizenship models.

The Citizenship Trap

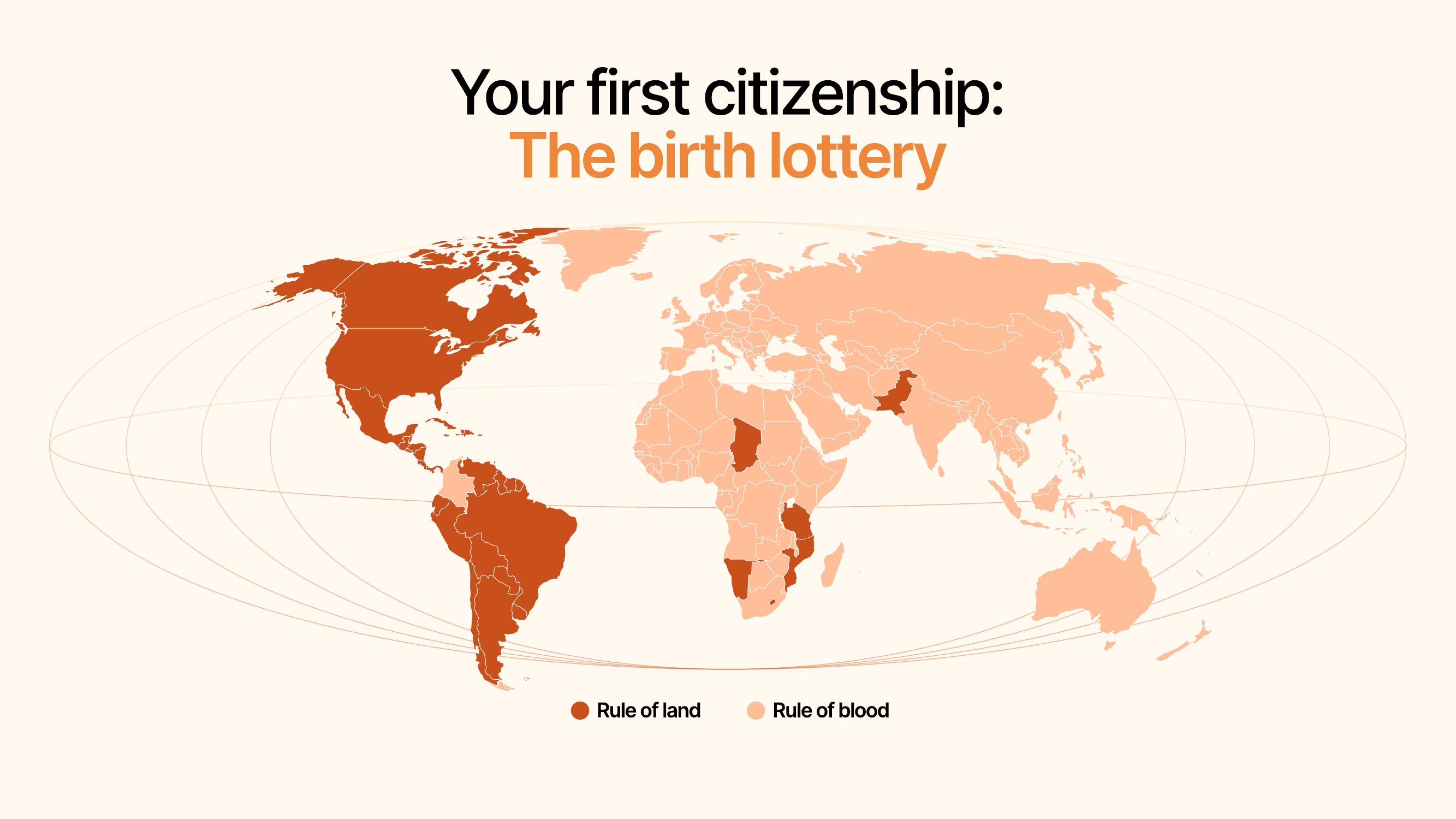

If you're fortunate enough to have been born in a country with a strong passport, you might never have confronted this reality.

But for billions across the globe, the simple accident of birth—their citizenship—acts as an invisible cage, constraining their opportunities, freedoms, and security.

This isn't just about travel. Your citizenship determines:

- Access to financial products and services

- Ability to incorporate companies

- Rights to own certain assets, including real estate

- Where you can live, work, and build a family

- Access to healthcare and basic services

- Physical safety and security

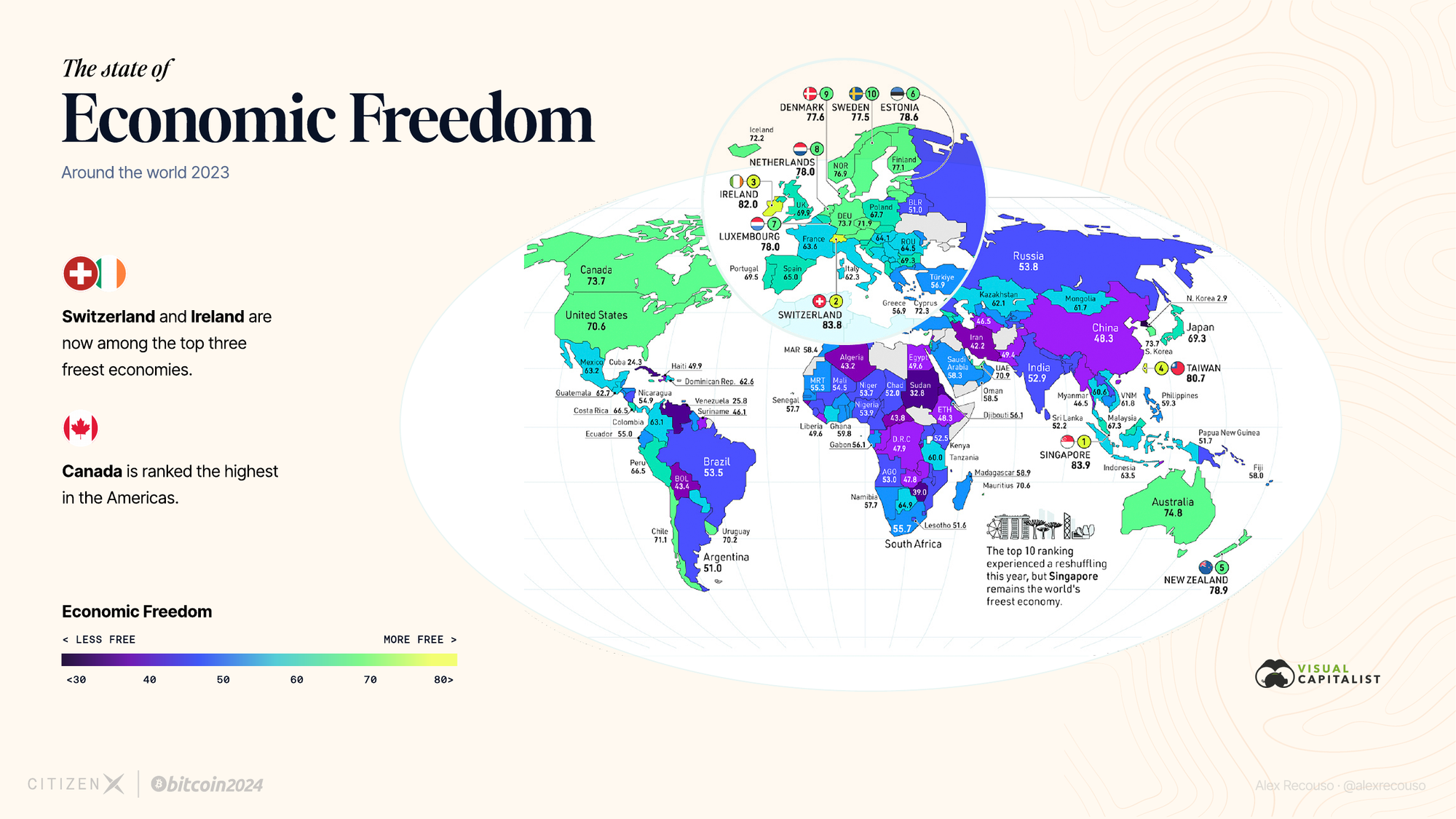

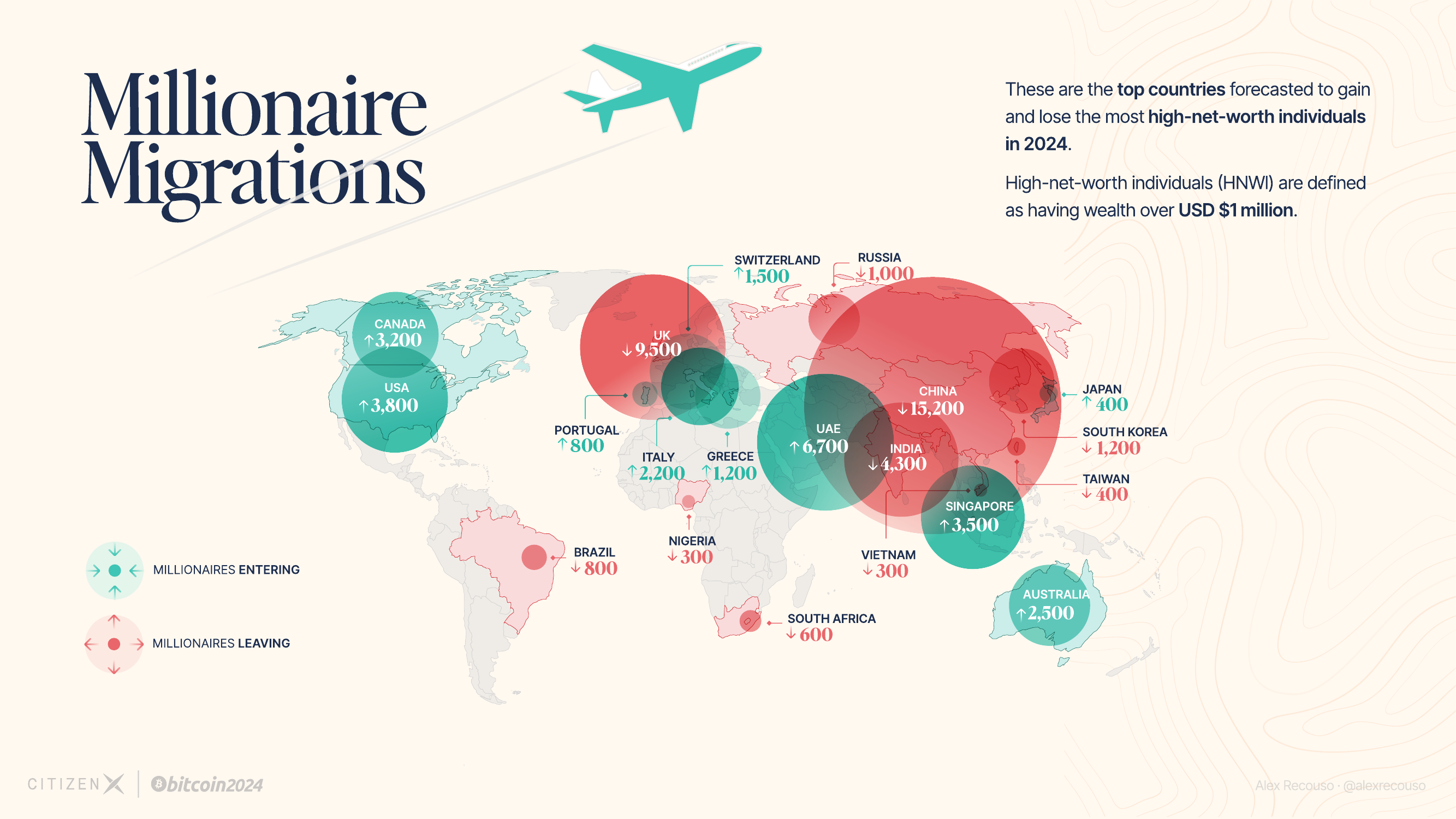

The divergence in ascending and descending countries

We're witnessing an unprecedented split in the global order: an ascending world and a descending world. Smart money is already responding to this reality.

Capital is flowing out of traditional large economies like the UK, India, Brazil, and China, finding new homes in ascending hubs like Dubai and Singapore. While the US and Canada still maintain net positive flows, this will likely not remain true by the end of this decade.

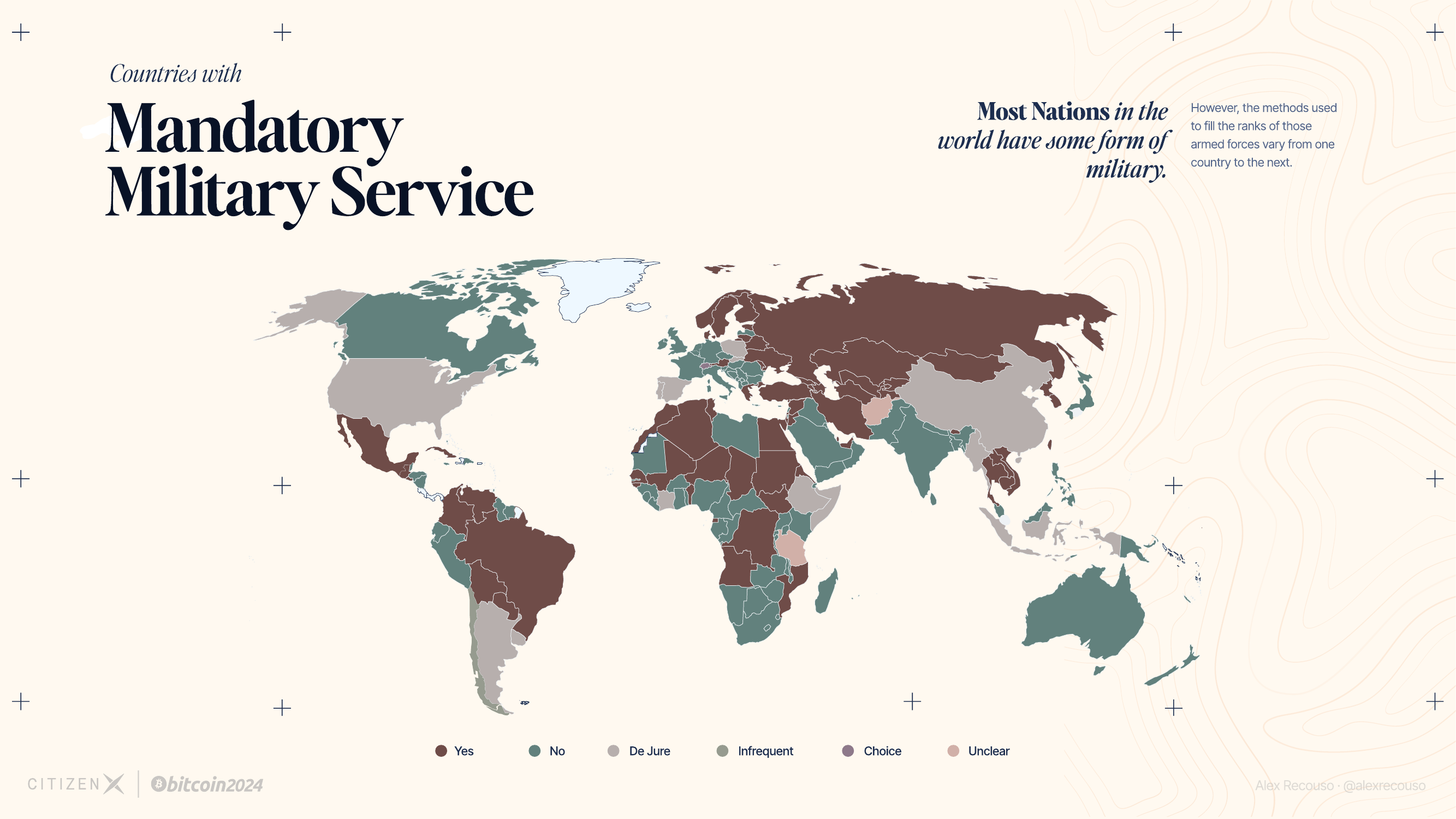

The ultimate insurance policy against overreach

Just as Bitcoin serves as insurance against monetary mismanagement, a second citizenship is the only insurance policy you can buy against government overreach.

Consider these recent developments:

- The UK contemplating reinstating military draft

- France and the Netherlands expanding exit taxes

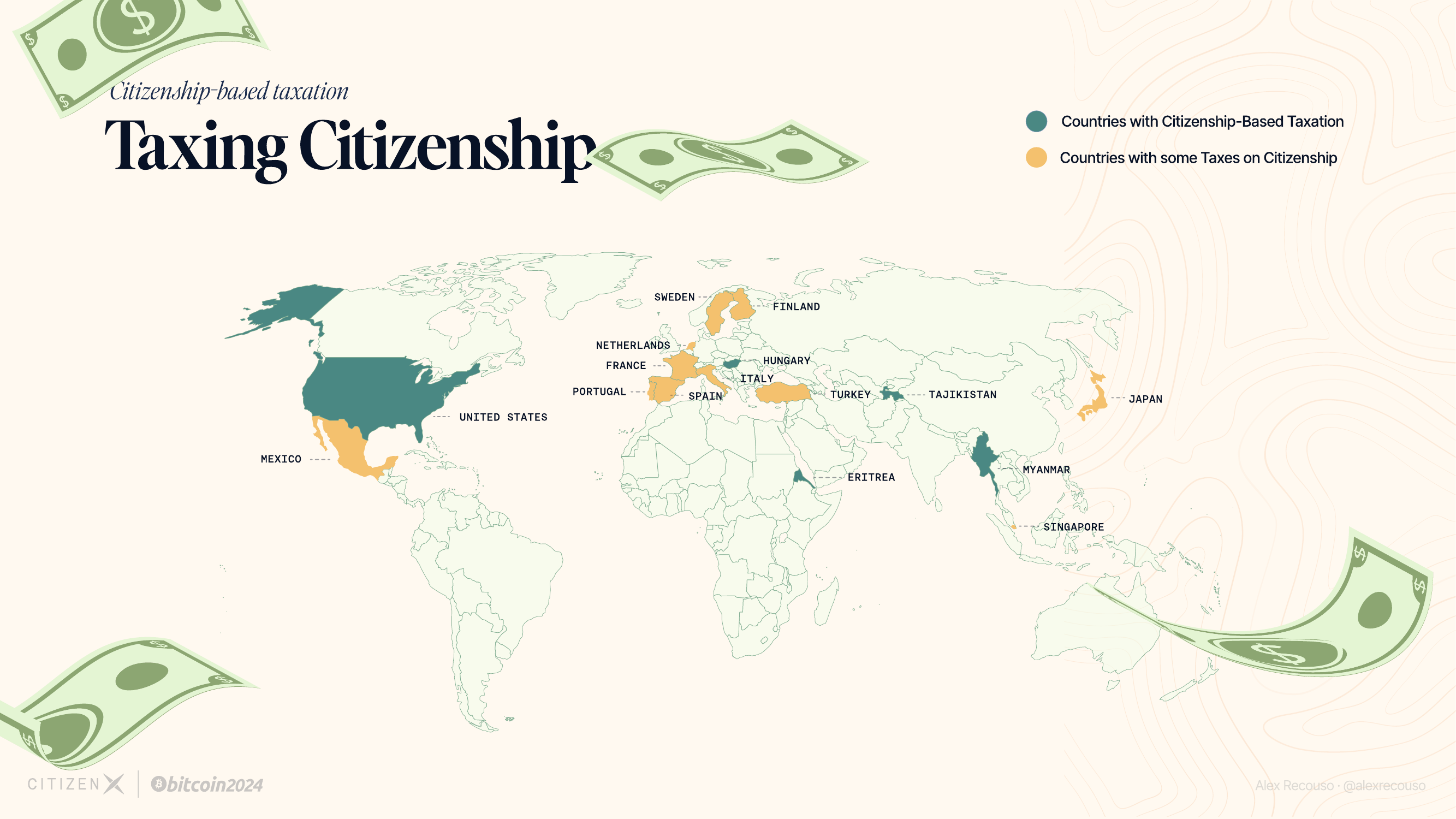

- The growing trend of citizenship-based taxation (a contagion that could expand beyond the United States and Eritrea)

Speaking of citizenship-based taxation—it's perhaps the most egregious example of how governments treat citizens like cattle.

Breaking free from the Citizenship Trap

The US IRS even has contingencies for continuing taxation in case of total nuclear war.

This isn't taxation—it's modern slavery.

Mobility is liquidity

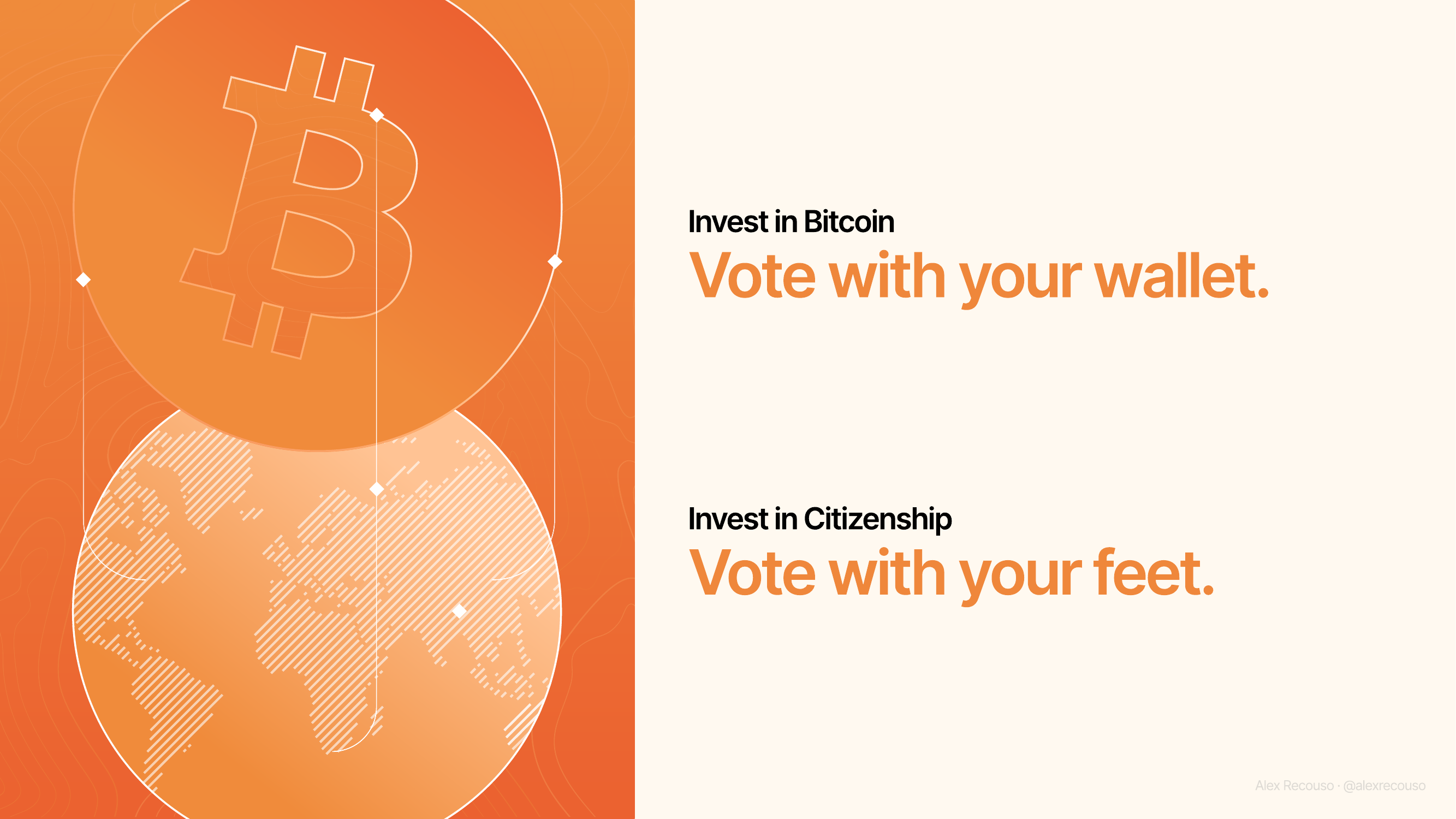

We value Bitcoin for its optionality—it creates an exit alternative to a system we no longer believe in.

Citizenship diversification offers the same: optionality for your physical and legal presence in the world.

In fact, citizenship represents the highest set of rights a country can grant, surpassing even the intermediate steps of permanent residency and golden visas.

If you have only one citizenship, that country owns you.

This is the citizenship trap—a system where your opportunities, freedoms, and security are dictated by the accident of birth. Just as Bitcoin liberates us from the fiat trap, diversifying your citizenship liberates you from the citizenship trap.

The parallels between Bitcoin and citizenship

The parallels between Bitcoin and citizenship diversification are striking:

- Both represent freedom from centralized control

- Both provide optionality and sovereignty

- Both serve as insurance against systemic risks

- Both represent a vote against the status quo

If you invested early in Bitcoin because of this, you should also invest in citizenship.

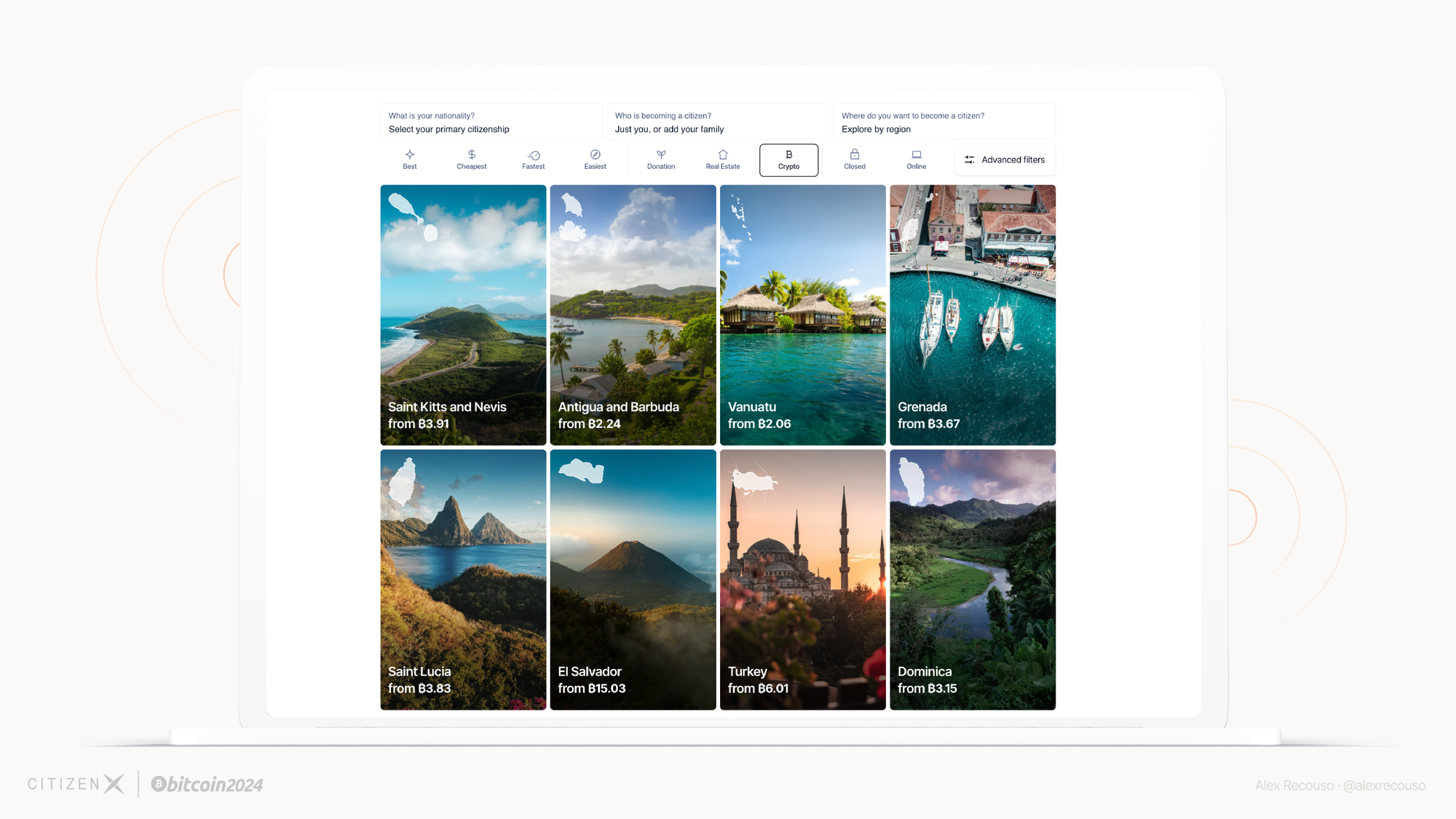

Citizenship as an asset in a Bitcoinized world

In the Bitcoinized world, the smart money isn't just diversifying its currency exposure—it's diversifying its passport portfolio.

The message is clear: invest in Bitcoin to vote with your wallet, invest in citizenship to vote with your feet.

The future belongs to those who understand that true sovereignty requires both financial and physical freedom. In a world of increasing uncertainty, the ability to move freely—both your capital and yourself—isn't just a luxury. It's a necessity.

Just as we wouldn't trust our entire savings to a government-controlled currency, why would we trust our entire future to one single citizenship?