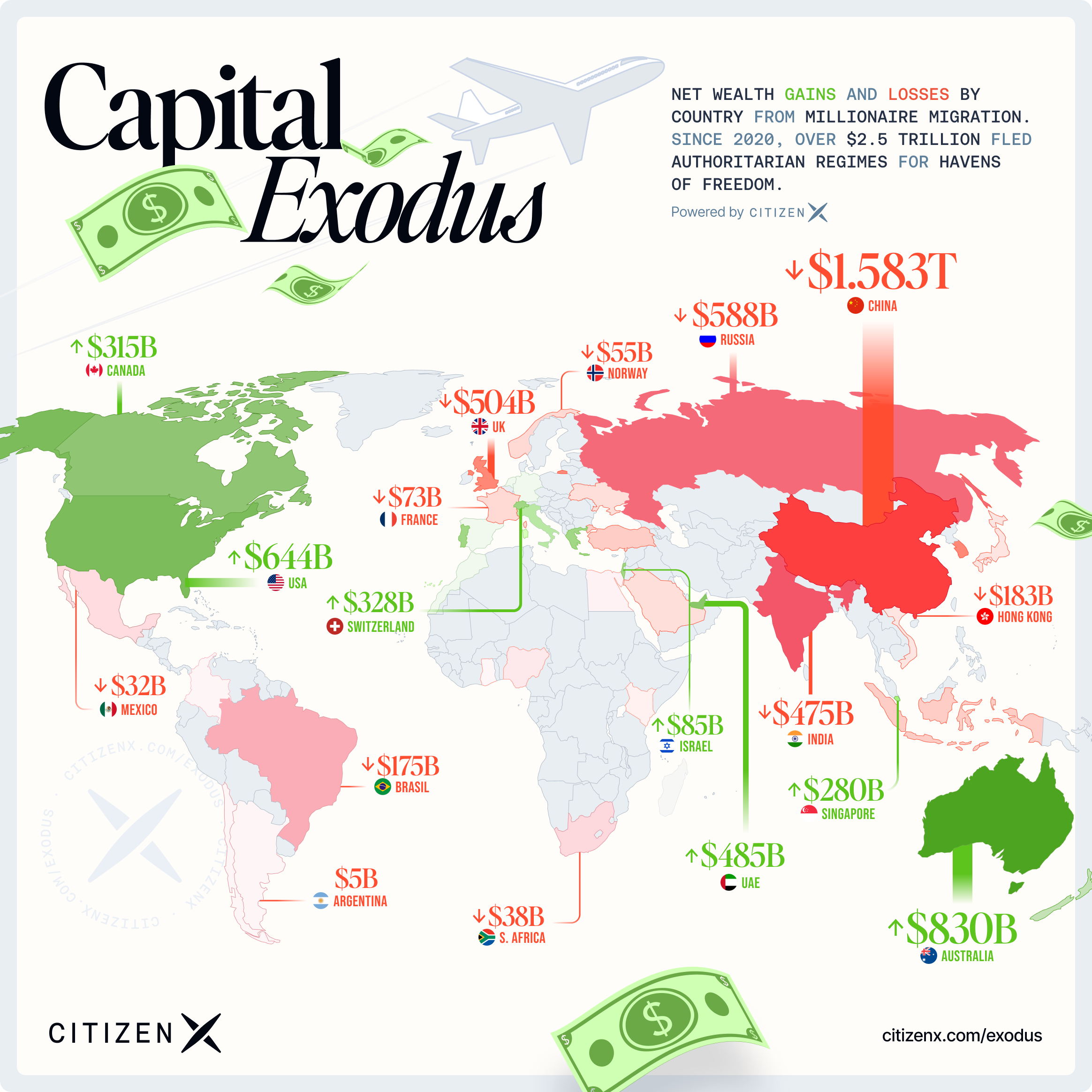

Today, we are excited to introduce the CitizenX Capital Exodus — a premier dashboard that maps real time wealth flows due to millionaire migration. Through our partnership with Inevitable Insights, we're bringing unprecedented transparency to how capital moves across borders.

A new way to measure prosperity

While most people focus on GDP to understand a country's economic strength, we believe alternative metrics such as economic freedom or wealth migration offer deeper insights.

GDP can be misleading – it counts government spending that might not create private wealth, ignores crucial property and stock market movements, and often fails to capture how well a country retains wealth within its borders.

That's why we've created a more sophisticated way to track where wealth is actually flowing.

"This is the best model for international governance competition. The net flow of high-net-worth individuals is a leading economic indicator. HNWIs have the skin in the game, liquidity, and mobility to respond to policy changes by voting with their wallets and their feet. For the first time in history, we can now visualize the market of countries."

Alex Recouso, co-founder and CEO of CitizenX

How we track global capital movements

Our methodology combines proprietary research through multiple sophisticated approaches with state-of-the-art predictive analytics to track genuine wealth migration.

We partnered with Inevitable Insights, an independent wealth intelligence firm, to analyze everything from financial flows and property transactions to residency patterns and digital asset movements.

Understanding what is considered wealth

When we talk about wealth migration, we're tracking three distinct groups.

- High-net-worth individuals have liquid assets exceeding $1 million and typically maintain sophisticated investment portfolios.

- Very high-net-worth individuals, with $30-50 million in assets, usually operate across multiple jurisdictions with diversified portfolios.

- Ultra high-net-worth individuals, controlling over $50 million, maintain complex wealth structures across many countries with sophisticated tax planning.

Privacy-first

As a Swiss-based company, we take data protection seriously. We focus on broader patterns and trends that help you understand where capital is flowing and why, and avoid using any personally identifiable information in our reports.

Why This Matters For You

Understanding wealth migration patterns isn't just about tracking numbers – it's about seeing where the world is heading. When wealth moves, it often signals important shifts: emerging safe havens, changing regulations, or new economic opportunities.

If you want to fix a broken system, you have to pull money OUT, not put more money IN.

— Marc Andreessen 🇺🇸 (@pmarca) September 26, 2024

If you put more money IN, the system interprets it as a reward and uses the money to become even more broken.

We get this for businesses. We forget it for nonprofits and governments. 🤔

The Capital Exodus helps you spot these patterns early, giving you the insights needed to make informed decisions about your citizenship and passport portfolio.

Exploring the future

The Capital Exodus may still contain traces of imperfection. If you spot errors or opportunities for improvement, please get in touch.

We will be enhancing the dashboard to provide even deeper insights. Our goal is to give you the most comprehensive view possible of global capital and wealth movements.

The Capital Exodus is available exclusively on citizenx.com/exodus