For over two centuries, the United Kingdom has offered wealthy international residents a unique tax advantage known as "non-dom" status.

This system allowed those who lived in Britain but considered another country their permanent home to legally shield their foreign income from UK taxation. It's been credited with helping London become a global financial powerhouse, attracting entrepreneurs, investors, and wealthy families from around the world.

But times are changing.

After years of incremental reforms, the UK government announced in Spring 2024 that it would effectively abolish the traditional non-dom regime from April 2025, replacing it with a more limited four-year tax exemption for newcomers.

This seismic shift in tax policy has sent shockwaves through affluent communities and triggered what some analysts are calling a "capital exodus."

Recent data confirms the scale of this departure: Britain lost a net 4,200 millionaires in 2023, with that number surging to an estimated 10,800 wealthy individuals leaving in 2024. This two-year outflow of over 15,000 high-net-worth individuals (HNWIs) is the highest in the world after China.

As these wealthy residents vote with their feet, seeking more favorable tax jurisdictions, the UK faces important questions about its future attractiveness to global capital, the impact on its economy, and the delicate balance between tax fairness and international competitiveness. This article explores the transformation of the non-dom regime, why it matters, and what the ongoing wealth exodus might mean for Britain's economic future.

The Historical Evolution of the Non-Dom Regime

The United Kingdom's non-domiciled tax regime has roots stretching back to the introduction of income tax in 1799. Originally designed to encourage international merchants and colonial investors to base themselves in Britain, the system allowed residents to pay UK tax only on foreign income if it was remitted (brought into the UK).

This "remittance basis" was formally limited to individuals who were not UK-domiciled or not ordinarily resident in 1914. For most of the 20th century, the fundamental principle remained unchanged: a UK resident non-dom pays UK tax only on foreign income or gains if and when those funds are brought to the UK.

The regime operated with minimal controversy for decades, quietly attracting wealthy foreigners to London's banks, property market, and business community. However, as wealth inequality became a more prominent political issue in the early 2000s, scrutiny of the non-dom system intensified.

The first major reform came in 2008, when the Labour Government introduced the Remittance Basis Charge (RBC). This annual levy required long-term non-dom residents to pay £30,000 if they had been UK residents for at least 7 of the prior 9 tax years and wished to continue using the remittance basis. It marked a significant shift – acknowledging the benefit non-doms received while asking them to make a greater contribution to public finances.

Further changes followed between 2012 and 2015, when the coalition government introduced higher charges for longer stayers. By 2015, non-doms resident for 17 of the past 20 years faced a substantial £90,000 annual charge to maintain their advantageous tax status.

The most sweeping reform prior to the current abolition came in April 2017 under the Conservative government. This effectively ended permanent non-dom status by introducing a "deemed domicile" rule. Anyone resident in the UK for 15 out of the past 20 years would now be deemed UK-domiciled for tax purposes, regardless of their actual domicile. These deemed domiciles could no longer use the remittance basis at all and would be taxed on worldwide income and gains like any UK domiciliary.

Additionally, the 2017 changes closed a loophole where UK-born individuals could emigrate, acquire a domicile of choice abroad, then return as "non-doms." It also targeted inheritance tax avoidance by making UK residential property held through offshore companies subject to UK inheritance tax.

Despite these significant restrictions, the core principle of the non-dom regime – that new arrivals could shelter foreign income from UK tax for a period – remained intact. However, mounting political pressure regarding perceived tax advantages for the wealthy culminated in the Spring Budget 2024 announcement by Chancellor Jeremy Hunt that the traditional non-dom regime would be abolished effective from April 2025.

This decision represented a dramatic policy shift and a political about-face, given that just months prior, the government had warned that scrapping non-dom status could "end up costing the UK economy £8bn" by driving wealth abroad.

Throughout its history, the non-dom regime has been both praised and criticized. Supporters credit it with attracting wealthy international investors and families to London for over a century, making the UK a top destination for migrating millionaires. Critics argued that allowing rich UK residents to live tax-free on offshore wealth while domestic citizens pay full tax was fundamentally unfair.

By April 2025, after successive reforms driven by this tension, the regime stands at a crossroads between maintaining competitiveness for HNWIs and addressing public demands for tax fairness.

The Current Legal Framework (April 2025)

As of April 2025, the UK's non-dom rules exist in a transitional state, governed by both the established remittance basis system and the new reforms taking effect. Understanding this framework is crucial to grasping why so many wealthy individuals are reconsidering their UK residency.

Under UK law, "residence" is determined by where you live year-to-year, whereas "domicile" is a distinct legal concept referring to your permanent home or the jurisdiction with which you have the strongest connection. Everyone has a domicile at birth (usually their father's country of origin), which can change only by acquiring a new "domicile of choice" in another country with intent to remain there permanently.

A UK non-domiciled individual is typically someone who lives in Britain but is legally recognized as having their permanent home elsewhere. To qualify for non-dom tax status, a person must be a UK tax resident, maintain a foreign domicile status, and claim non-domiciled status in their self-assessment tax return.

The key advantage of non-dom status is the option to be taxed on the "remittance basis" rather than the "arising basis" that applies to most UK residents. Under the remittance basis, foreign income and gains are taxable in the UK only if and when they are remitted. Any income or capital gains earned abroad that remain outside the UK are not subject to UK tax.

In practice, non-doms pay UK tax in full on all UK-source income and gains, pay UK tax on any foreign income or capital gain remitted to the UK, but owe no UK tax on foreign income/gains that remain outside the UK and are not used for UK benefits.

There are trade-offs, however. Non-doms who claim the remittance basis give up certain UK tax allowances and reliefs, including the tax-free Personal Allowance and the annual Capital Gains Tax exemption. Additionally, longer-term residents face the Remittance Basis Charge – currently £30,000 per year once a non-dom has been UK resident in at least 7 of the previous 9 tax years, rising to £60,000 per year once resident in at least 12 of the previous 14 years.

Since 2017, the "deemed domicile" rule has imposed an absolute time limit on non-dom status. Once an individual has been UK resident for 15 out of the past 20 tax years, they become deemed domiciled in the UK and can no longer claim the remittance basis at all.

Beyond income and capital gains, non-doms enjoy significant inheritance tax advantages. Those who are not UK-domiciled (and not yet deemed domiciled) are liable to UK inheritance tax only on UK assets. Their foreign assets remain outside the scope of UK inheritance tax, potentially saving tens of millions in estate taxes for the wealthiest families.

Many non-doms also use non-resident trusts to their advantage. If a non-dom settles an irrevocable trust offshore before becoming deemed domiciled, that trust can "shield" assets from UK taxation going forward. These "excluded property trusts" have been a cornerstone of succession planning for globally mobile families.

The April 2025 Reforms: A New Four-Year Regime

The major reform taking effect from April 6, 2025, represents a fundamental shift in the UK's approach to taxing foreign residents. The traditional domicile-based remittance regime is being replaced with a more straightforward, time-limited "tax holiday" for recent arrivals.

Under the new system, individuals moving to the UK who have been non-resident for the prior 10 tax years can claim a foreign income and gains exemption for their first four UK tax years. This resembles the old remittance basis but is now based purely on years of residence rather than the domicile concept.

During this four-year window, newcomers can freely remit overseas income or capital without UK tax – essentially a short-term tax holiday on offshore earnings. After these four years, they will become fully taxable on worldwide income like everyone else.

Crucially, from April 2025 onward, an individual's domicile status is no longer relevant for UK tax. Taxation will depend solely on residence and the number of years in the UK. This greatly simplifies matters – replacing a subjective test (domicile) with an objective one (years present).

Recognizing that abruptly ending the remittance regime could spur a mass exodus of current non-doms, the government has introduced several transitional measures:

- A two-year 12% repatriation window: During 2025–26 and 2026–27, existing non-domiciled residents can remit their offshore income/gains at a flat 12% tax rate – much lower than standard income or capital gains tax rates.

- A 50% foreign income exemption in 2025–26: In the first year of the new rules, those who were remittance basis users will get a 50% reduction in UK tax on foreign income earned that year.

- Asset re-basing: Non-doms who have previously claimed the remittance basis are allowed to "rebase" their offshore assets to their market value as of April 5, 2019, for UK Capital Gains Tax purposes. This means any gain that accrued before that date won't be taxed when they eventually sell.

- Business Investment Relief continuation: The BIR scheme, which allows non-doms to remit foreign income tax-free if invested in qualifying UK businesses, will remain in place for funds sheltered under the old regime.

The reforms also abolish the special tax protections for non-UK resident trusts going forward. From 2025, non-doms will be taxed on trust income and gains as they arise (if they are UK resident), ending the deferral advantages of offshore trusts. However, existing trusts' inheritance tax benefits are preserved – foreign assets placed into trust before April 2025 will still be treated as excluded from the settlor's estate for inheritance tax.

These changes represent the end of the 15-year non-dom era in favor of a strict four-year tax holiday for foreign income. After four years, new residents will be fully integrated into the UK tax system, a drastic reduction in the timeframe wealthy individuals can benefit from preferential tax treatment.

Financial Implications for High-Net-Worth Individuals

The non-dom regime has had profound financial implications for those choosing to live in the UK. It offers attractive tax benefits but also comes with costs, complexities, and risks that wealthy individuals must carefully weigh.

The primary benefit has been the ability to shield foreign income and gains from UK taxation. For a wealthy individual with substantial investment income from overseas trusts, businesses, or portfolios, this could mean avoiding UK income tax (45% for additional-rate taxpayers) and capital gains tax (20% on most assets, 28% on residential property) on those earnings by keeping them outside Britain.

For example, a non-dom with a $10 million investment portfolio generating $500,000 annually in dividends and interest abroad would pay zero UK tax on that income, as long as they reinvest or spend it offshore. Over a decade, the savings compared to being taxed at 45% could amount to millions of pounds.

Beyond yearly income, capital gains tax planning has been a major draw. Non-doms can dispose of non-UK assets without triggering UK CGT, provided the proceeds remain offshore. This is particularly valuable for entrepreneurs or investors who expect to realize large gains from selling foreign assets.

Another critical benefit is in estate planning. UK inheritance tax doesn't apply to offshore assets for a non-dom, offering a lawful escape from the UK's 40% inheritance tax on estates above the threshold. For a wealthy individual with a £50 million estate mostly in global investments and properties, this could save their heirs tens of millions in inheritance tax compared to being UK-domiciled.

Many HNWIs use offshore trusts to lock in these benefits for the long term. A trust set up in Jersey or Bermuda before becoming deemed domiciled can hold and grow investments free from UK taxes, even after the settlor has been in Britain for 15+ years. Properly structured, such trusts aren't subject to UK inheritance tax in the settlor's estate and can defer or avoid UK capital gains tax on non-UK investments.

Paradoxically, the non-dom regime has also enabled more investment into the UK through Business Investment Relief. This allows non-doms to bring foreign funds into UK enterprises without losing the tax advantage, creating a win-win: the individual diversifies into UK assets, and the UK economy benefits from the capital influx.

Another often overlooked benefit is that a non-dom on remittance basis doesn't have to report details of their offshore income to HMRC if it's not remitted, affording a level of financial privacy that many HNWIs appreciate.

However, the regime also comes with significant risks and challenges. Perhaps the biggest is that the favorable rules can change with political winds – as indeed has happened in 2017 and 2024. Wealthy individuals often make long-term plans, and sudden changes like the new 4-year limit can upend those strategies.

The remittance basis rules are notoriously complex, and a simple misstep can trigger unexpected tax bills. For instance, if an HNWI inadvertently uses offshore income to pay for something that benefits a UK resident, it could count as a taxable remittance. The rules extend to assets brought into the UK as well – even temporarily bringing in artwork purchased with untaxed foreign income could potentially constitute a remittance.

Using the regime can also be expensive administratively. The Remittance Basis Charge of £30,000-£60,000 is itself a cost that only makes sense if the tax saved exceeds it. Additionally, HNWIs typically incur significant professional fees for accountants, tax advisors, and lawyers to navigate the non-dom rules.

In recent years, HMRC has grown more aggressive in challenging individuals claiming non-UK domicile. As one private client expert noted, "HMRC have raised an increasing number of enquiries to test whether someone is not UK domiciled, and there is a good degree of subjectivity involved." For HNWIs, this presents a risk that after years of arranging their taxes, they might face an investigation and potentially a ruling that they were UK domiciled after all.

Non-doms must also consider the negative public perception sometimes associated with their status. High-profile cases like the criticism of the UK Chancellor's spouse for using non-dom status highlight the reputational risks involved. Some might choose to voluntarily forgo the status to avoid bad press or to take a position of being a "full taxpayer" in the UK community.

To maximize benefits and mitigate risks, HNWIs have developed sophisticated planning strategies. These include segregating funds into separate bank accounts for different types of money, setting up offshore trusts and companies before hitting the deemed domicile threshold, timing asset sales to occur while still eligible for the remittance basis, leveraging double taxation treaties, and maintaining top-tier professional advice.

Some also plan exit strategies. Before becoming deemed domiciled or before the 4-year window closes, they might relocate to another country with a favorable regime like Ireland, Italy, UAE, or Portugal. They often extract or remit funds just before leaving under one last low-tax opportunity or use Business Investment Relief to invest in assets they can later sell.

The "Capital Exodus": Why HNWIs Are Leaving the UK

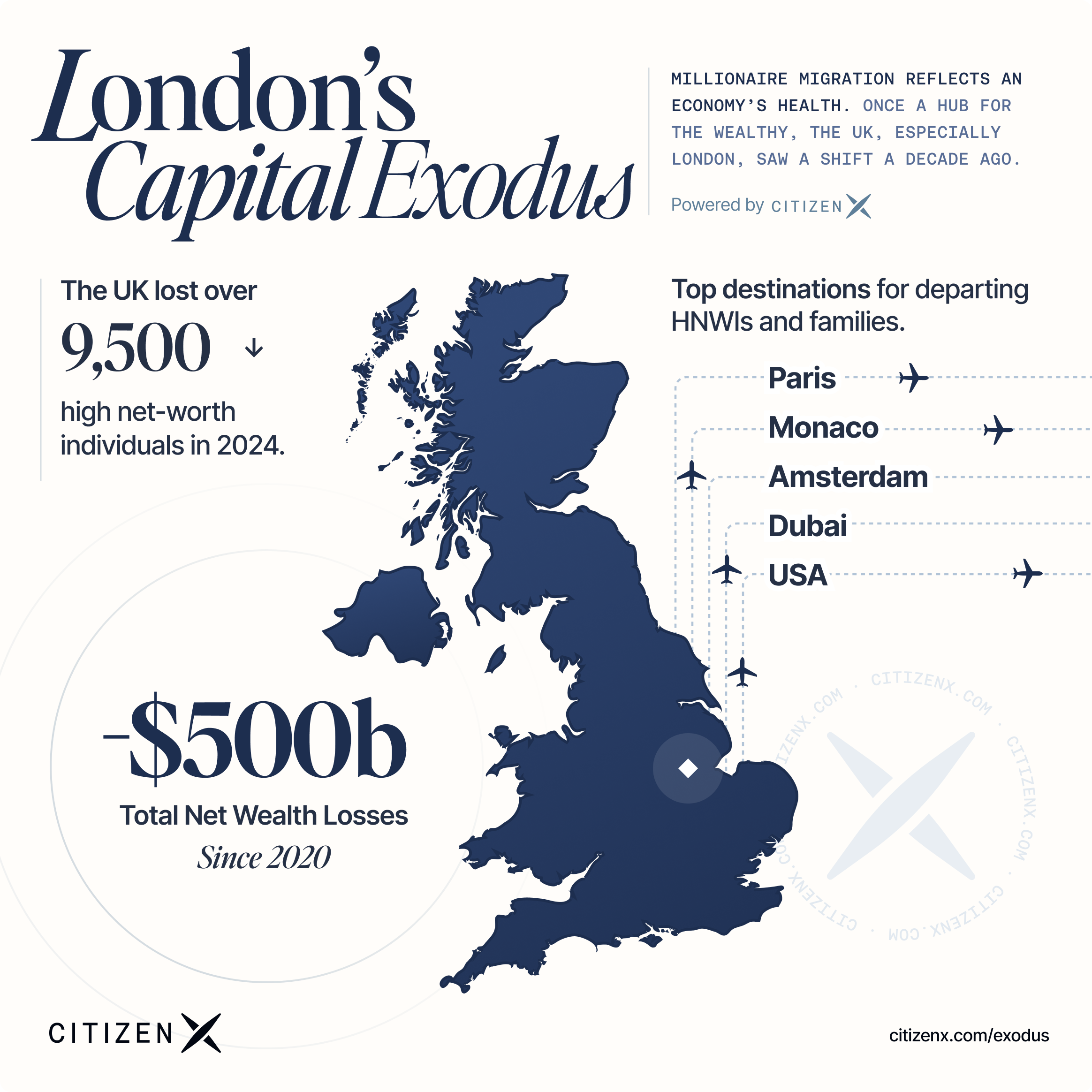

The UK has witnessed a notable outflow of millionaires and HNWIs in recent years, a trend that has accelerated dramatically since the announcement of non-dom reforms. Britain saw a net loss of about 4,200 millionaires in 2023, which surged to an estimated 10,800 millionaires leaving in 2024. This two-year outflow of over 15,000 wealthy individuals is the highest in the world after China.

Several key factors are driving this exodus:

Tax Policy Changes and Uncertainty

The UK's recent tax policy direction has unnerved HNWIs. The targeting and reform of the non-dom regime is a primary factor. Wealthy non-doms feel they have been "targeted with additional taxes," prompting many to depart. The introduction of the 15-year limit in 2017 and now the virtual abolition of non-dom status sends a message that the generous treatment they relied on is ending.

As one wealth intelligence analyst put it, "Wealthy non-doms have been targeted with additional taxes, which has prompted many of them to leave the country." HNWIs interpret these moves as the UK becoming less welcoming to international wealth.

Moreover, the broader tax landscape has turned less favorable: the top income tax rate of 45% is high, dividend and capital gains tax rates have risen in recent years, and thresholds (like the £325,000 inheritance tax nil-band) have been frozen – dragging more people into paying 40% estate tax due to inflation.

There's also fear of future tax hikes or new taxes. The opposition Labour Party has floated ideas of wealth taxes or further non-dom crackdowns. This uncertainty is a powerful push factor: many affluent individuals prefer to secure a stable tax residency elsewhere rather than be the "last one out" if the UK were to impose even harsher measures.

High Effective Tax Rates on Capital and Estates

Even aside from the non-dom issue, the UK imposes some of the world's highest taxes on capital gains and inheritance. The capital gains tax top rate (28% on property, 20% on others) and the dividend tax (up to ~39% combined with corporation tax for business owners) make the UK relatively unattractive for investors, especially when compared to countries with no CGT (e.g., Switzerland on certain assets, or Monaco with none) or lower rates.

Likewise, the 40% inheritance tax on estates over a low threshold stands out globally – many countries have no estate tax or much lower rates. A public analysis noted that "capital gains tax and estate duty rates in the UK are among the highest in the world, which deters wealthy business owners and retirees from living there."

For an entrepreneur who built a company, the prospect of nearly half of their estate going to the taxman or paying a large chunk on the sale of a business can be a deal-breaker. Countries like the US, historically seen as high-tax, now actually offer better estate tax planning for non-citizens than the UK does for long-term residents.

Hostile Climate and Public Attitudes

A more intangible but frequently cited reason is the changing tone in the UK towards wealth. HNWIs often feel that the public narrative has turned hostile to "the rich" or "wealth creators." Political discourse frequently spotlights non-doms or calls for "the wealthy to pay their fair share," which some interpret as scapegoating.

The Adam Smith Institute, in tracking millionaire migration, noted a "culture hostile to wealth-creators" as a factor in millionaires leaving. This includes everything from media portrayal (non-doms painted as tax evaders) to actual policy proposals like mansion taxes or super-taxes on bankers.

To the extent that HNWIs do not feel welcome or respected in a society, they are more inclined to leave despite material factors. The controversy over the non-dom status of the UK Prime Minister's wife in 2022 led to widespread criticism and a narrative that non-doms exploit loopholes, which in turn made many law-abiding non-doms feel unfairly vilified.

The peace of mind that comes from living in a place where one isn't under fire for one's wealth is something money can indeed buy – by relocating.

Global Mobility and Competing Jurisdictions

Today's HNWIs are extremely mobile and have more choices than ever. If the UK tightens the screws, there's always Dubai, Singapore, Monaco, Switzerland, the U.S., or emerging destinations like Saudi Arabia offering political stability and often much lower taxes.

For instance, Dubai (UAE) has no income or gains tax, a luxury lifestyle, and has attracted many British millionaires recently. Monaco famously has no income tax and has seen an uptick of British applicants as well. Singapore and Hong Kong offer vibrant business hubs with territorial tax systems.

Even within Europe, Italy introduced a new resident non-dom flat tax, Portugal and Spain have regimes to lure affluent expats, and Switzerland still offers lump-sum taxation deals. These alternatives have improved over the last decade, eroding the unique advantage London once had.

As one report observed, "for many years (1950s to early 2000s) the UK consistently attracted large numbers of wealthy families... However, this trend began to reverse around a decade ago as more millionaires began to leave and fewer came in." Part of this reversal is due to other countries catching up or surpassing the UK in attractiveness.

According to projections, Paris, Dubai, Amsterdam, Monaco, Geneva, Singapore, and even places like Florida and Malta are among the top destinations for millionaires leaving the UK in 2024. The knowledge that one can move and potentially improve one's tax and lifestyle position makes leaving a logical choice when the UK's relative advantage declines.

Quality of Life Factors

Financial reasons aside, some HNWIs cite quality of life issues in the UK as contributing factors – essentially "push factors" that make the decision to leave easier. These include concerns about security (high-profile crimes or perceived declines in safety, especially in London), and strains on public services.

The New World Wealth report pointed out "the healthcare system in the UK is deteriorating and there are increasing safety concerns, especially in big cities such as London." Wealthy individuals can of course opt for private healthcare and security, but general social conditions do impact their comfort.

Additionally, Brexit diminished London's cosmopolitan appeal for some international families; the ease of doing weekend trips to Paris or sending kids to European universities has changed. While these factors alone might not drive out the wealthy, combined with tax motives, they add weight to the decision.

Consequences of the Capital Flight

The consequence of this capital flight is significant. During 2017–2023 (the post-Brexit years), the UK lost an estimated 16,500 high-net-worth individuals on net. The trend accelerated sharply in 2024 with the looming non-dom changes – an estimated 9,500 millionaires (net) left in that single year.

Analysts note this is a "worrying leading indicator of economic health," as many millionaires are entrepreneurs and investors who fuel growth and create jobs. Their departure can mean lost investment, fewer business startups, and reduced consumption of high-end goods and services in the UK.

Moreover, this group contributes a disproportionate share of tax revenues; for example, the top 1% of earners (a group overlapping with HNWIs) pay about 29% of all UK income tax. If too many leave, the tax base erodes, potentially costing the Treasury far more than what might be gained by closing the non-dom "loophole."

This argument was even acknowledged by the Chancellor previously warning that scrapping non-dom status could cost £8 billion due to lost spending and investment.

From a sympathetic standpoint, HNWIs who are leaving often feel they have contributed significantly – through taxes, business activities, and philanthropy – and that the UK's changing policies signal that their contributions are undervalued. As the Adam Smith Institute put it, "A withdrawal of millionaires is counterproductive for British growth," noting that many are wealth creators whose capital was driving domestic investment.

They argue that rather than squeezing this group, the UK should aim to retain and attract them by improving the tax environment (for instance, by cutting capital gains and corporation tax, or by matching competitor nations' incentives). The exodus itself might in time force a policy re-think if the economic impact becomes evident.

The New Reality for International Wealth Creators

For both current UK residents and potential newcomers, the post-2025 landscape presents a dramatically different proposition. The fundamental question for many is: "Is the UK still worth it?"

Under the new system, anyone considering moving to the UK faces a stark timeline. They'll get a four-year window where foreign income and gains can remain untaxed, but after that, they're fully integrated into the UK tax system. For some, this simply isn't long enough to justify a major life relocation.

Take, for example, a successful entrepreneur from Asia who sells their business for $50 million and is looking for a new base. Previously, they might have chosen London, knowing they could enjoy British life for up to 15 years while keeping their overseas investments tax-free as long as they didn't bring the money in. Now, with only four years, the calculus changes dramatically. They might opt instead for Dubai (zero tax indefinitely), Singapore (territorial taxation system), or even Italy (15-year flat tax for new residents).

For existing non-doms approaching the end of their preferential tax treatment, the decision is even more pressing. Many are accelerating exit plans they might have delayed under the old regime. The transitional reliefs (12% repatriation rate, asset rebasing) are seen as a short-term sweetener but don't address the long-term issue – after 2027, the UK will simply be a high-tax jurisdiction for anyone who stays.

Wealth advisors report unprecedented demand for relocation services from long-term UK residents with international ties. Family offices are instructing teams to review all options, comparing tax regimes across multiple potential destinations and assessing impacts on lifestyle, education, healthcare, and business connectivity.

Interestingly, some non-doms are adopting a "touch and go" approach – maintaining minimal UK presence to avoid tax residency while keeping homes and some activities in Britain. This creates a scenario where the UK gets neither their full presence nor their tax contribution – an unintended consequence of the policy shift.

For the UK's professional services sector that caters to wealthy international clients, the exodus represents both a challenge and an opportunity. Law firms, tax advisors, and private banks are seeing increased demand for exit planning services but may face a long-term decline in their UK-based international clientele.

Real estate is another sector feeling the impact. High-end property in London, traditionally buoyed by international wealth, has shown signs of cooling as non-doms reconsider their UK footprint. Some are selling London properties ahead of potential tax changes, while others are downsizing from primary residences to pied-à-terres that they'll use only occasionally as non-residents.

The hospitality, luxury retail, and cultural sectors that benefited from wealthy non-doms' discretionary spending may also see ripple effects. A non-dom family spending millions annually in London shops, restaurants, private schools, and cultural institutions represents significant economic activity that isn't easily replaced when they leave.

For UK financial institutions, the challenge is keeping these clients' wealth under management even as the individuals relocate. Many banks are strengthening their international presence, offering seamless private banking across multiple jurisdictions to retain clients who are physically leaving the UK.

Alternative Destinations: Where the Wealth is Heading

As wealthy individuals reconsider their UK residency, alternative destinations are actively courting them with favorable tax regimes and lifestyle benefits. Understanding these competitors helps explain the UK's challenge in retaining global wealth.

Dubai has emerged as perhaps the leading beneficiary of the UK's wealth exodus. The United Arab Emirates offers zero income tax, zero capital gains tax, and zero inheritance tax – a compelling proposition for any HNWI. Dubai combines these tax advantages with luxury infrastructure, international schools, world-class healthcare, political stability, and excellent global connectivity. The city has launched specific visa programs targeting wealthy individuals and has positioned itself as a safe harbor for international wealth. Its transformation from regional hub to global wealth center has accelerated dramatically in recent years.

Portugal, despite recent changes to its Non-Habitual Resident (NHR) program, remains attractive. The country offers a blend of European lifestyle, relatively low cost of living, and specific tax incentives for newcomers. While the NHR program no longer provides the same level of tax exemption it once did, Portugal continues to draw British retirees and entrepreneurs looking for a softer landing than the UK's high-tax environment.

Italy has created an aggressive bid for mobile wealth with its own non-dom program. For a flat annual tax of €100,000, regardless of how much foreign income you earn, wealthy new residents can shield all their non-Italian income from Italian taxation for up to 15 years. This program directly competes with the UK's new four-year exemption by offering nearly four times the duration at a predictable cost. Combined with Italy's lifestyle appeal, it's proving particularly attractive to wealthy Britons with Mediterranean sensibilities.

Singapore continues its ascent as Asia's premier wealth hub, offering a territorial tax system (generally only Singapore-source income is taxed), strong rule of law, excellent education, and a strategic location for Asian business. The city-state has attracted numerous family offices, hedge funds, and wealthy entrepreneurs from the UK, particularly those with business interests in Asia.

Switzerland, the traditional destination for wealth, remains competitive with its lump-sum taxation system. Non-Swiss citizens with no Swiss business activities can negotiate a flat annual tax based on their living expenses rather than their actual income or wealth. Combined with Switzerland's legendary privacy, security, and quality of life, it continues to attract wealthy Britons despite its high cost of living.

Monaco, with its zero income tax policy, luxury lifestyle, and proximity to Nice International Airport, has long been a destination for British tax exiles. Though space-constrained and extremely expensive, it offers unparalleled tax advantages in a European setting and continues to see applications from wealthy UK residents.

The United States, interestingly, has become more attractive for certain HNWIs. While not a low-tax jurisdiction overall, the US offers specific advantages for non-citizens, particularly in estate planning. With proper structuring, a non-US citizen can potentially shield non-US assets from US estate tax – ironically, something that's becoming harder to achieve in the UK for long-term residents. Cities like Miami, with no state income tax in Florida, have seen particular interest from UK-based Latin Americans and Europeans.

These competing jurisdictions haven't just passively received departing UK wealth – they've actively courted it. Many have introduced specific programs targeting internationally mobile HNWIs, offering clear, predictable tax treatment and streamlined immigration processes. This competitive landscape makes the UK's decision to tighten its non-dom regime all the more consequential.

The Future: Can the UK Remain Competitive?

As the UK implements its non-dom reforms, policymakers face the challenge of balancing revenue goals with maintaining the country's attractiveness to global capital. The question isn't just about tax – it's about the UK's economic model and future prosperity.

Some argue that the four-year exemption for newcomers strikes the right balance – offering a reasonable adjustment period while ensuring everyone eventually contributes fairly to the public purse. This view holds that being a tax haven for the world's wealthy was unsustainable politically and that the UK's fundamental attractions (language, legal system, culture, education) will keep it competitive regardless of tax policy.

Others warn that the UK has miscalculated, pointing to the accelerating outflow of wealth and talent. They fear a self-reinforcing cycle where departing wealth leads to reduced investment, fewer jobs, and ultimately lower tax revenue – forcing either higher taxes on those who remain or cuts to public services, making the UK even less attractive.

Looking ahead, several scenarios could emerge:

The UK could double down on its current approach, perhaps extending the new non-dom replacement regime beyond four years if the exodus proves economically damaging. This would represent an acknowledgment that international competition for mobile wealth is a reality that can't be ignored.

Alternatively, the UK might pivot to a more comprehensive tax reform, lowering overall rates (particularly on capital and inheritance) to create a more broadly competitive system rather than special treatment for foreigners. Some advocates argue this would be both fairer and more effective at retaining and attracting wealth.

A third possibility is a shift away from competing on tax altogether. Under this approach, the UK would accept some wealth outflows as the price for a more equitable tax system, focusing instead on other competitive advantages: its universities, creative industries, technology sector, and quality of life. The argument here is that human capital and innovation, not tax arbitrage, should drive the next phase of British prosperity.

What's clear is that the status quo is already changing. The capital exodus underway represents a real-time market response to the UK's policy shift. Whether this proves to be a short-term adjustment or the beginning of a longer-term repositioning of London's role in global finance depends on both policy choices and how international competitors respond.

For individuals caught in this shifting landscape, the calculus is complex. Those with genuine ties to the UK – family, business interests, emotional connections – may accept the higher tax burden as the cost of remaining in a country they love. Others with looser connections may find the financial case for leaving compelling.

Conclusion: Finding the Right Balance

The UK's non-dom regime has been a cornerstone of London's appeal to global elites for over a century – a unique arrangement allowing internationally mobile HNWIs to enjoy Britain's opportunities while preserving their offshore wealth. The current transition represents a fundamental shift: the traditional indefinite remittance basis is giving way to a short-term resident-based exemption, fundamentally altering the landscape for wealthy internationals in Britain.

The financial impact of non-dom status has been significant – offering tremendous benefits to those who qualified while also contributing to the UK's reputation as a welcoming destination for global capital. At the same time, it came with complexities and an implicit understanding that it was a temporary privilege. The recent capital exodus suggests that many HNWIs, when pressed with higher taxes or uncertainty, will simply move elsewhere.

From one perspective, these individuals are rational economic actors who gravitate to environments where their success is rewarded rather than penalized. From another, they've benefited from UK infrastructure, services, and stability while contributing less than their fair share to the system that supported them.

The UK's challenge going forward will be finding the right balance in its tax policy – ensuring fairness and revenue, while not driving away the very people who contribute disproportionately to growth and the public purse. As one think-tank urged, the government should consider making Britain more "globally competitive" for HNWIs to stem the outflow.

Whether the UK can reinvent its offer to global wealth in time will be crucial. Otherwise, the term "non-dom" may become a relic of history, and Britain could find that the world's wealth – and the benefits it brings – increasingly lies beyond its shores.

In an era of unprecedented mobility for capital and talent, no country can afford to ignore the competitive dynamics of global wealth attraction. The UK's experiment in abolishing long-standing tax privileges for foreigners will provide a fascinating case study in whether national tax policy can still effectively govern wealth in an age where borders present fewer barriers than ever before.