As of 2023, his net worth is estimated to be between $1.5 billion and $2 billion.

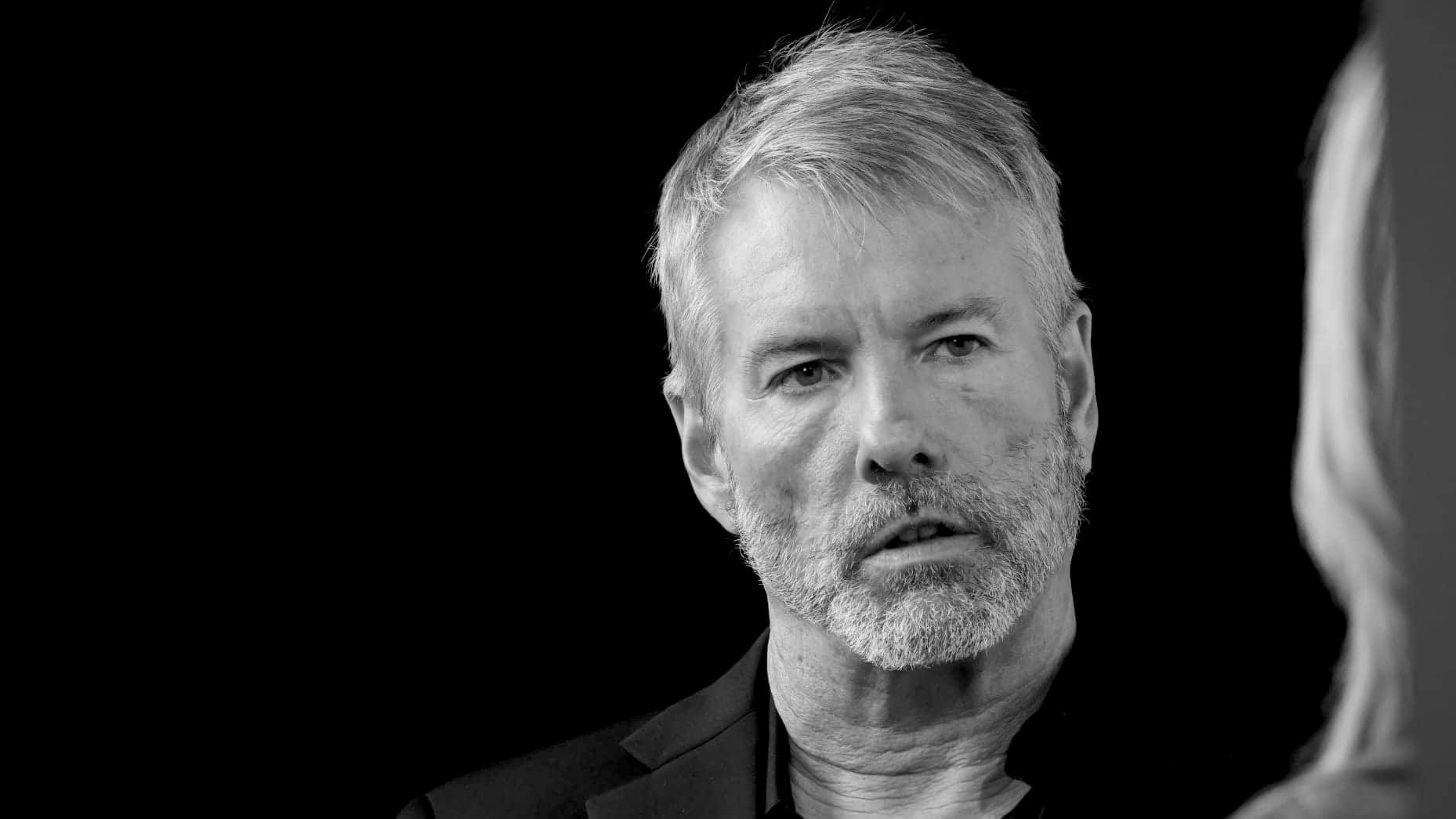

Michael Saylor is a name that resonates strongly in both the business and cryptocurrency worlds.

As the CEO of MicroStrategy, a company known for its software and business intelligence solutions, Saylor made waves by adopting Bitcoin as a primary treasury asset for his corporation.

His bold move to invest billions of dollars into Bitcoin has not only influenced other CEOs but also solidified his status as one of the most prominent voices in the crypto space.

In this article, we'll delve into Saylor's journey, from his early success in the tech industry to his transformative bet on Bitcoin.

We'll explore his strategies, net worth, views on decentralization, and touch on his citizenship and how it influences his global perspective on finance.

Net Worth: The Impact of Bitcoin on Saylor's Fortune

Michael Saylor's net worth has seen significant fluctuations, largely tied to the price of Bitcoin and MicroStrategy's stock.

As of 2023, his net worth is estimated to be between $1.5 billion and $2 billion, though it changes with Bitcoin’s volatile market. A considerable portion of his wealth comes from his stake in MicroStrategy, which soared in value alongside Bitcoin's price increases.

Saylor himself is a major holder of Bitcoin. Separate from MicroStrategy’s investments, he has publicly stated that he owns over 17,000 BTC.

This personal investment underscores his deep conviction in Bitcoin as the future of finance. When Bitcoin reached its peak prices in 2021, Saylor’s Bitcoin holdings alone were valued at hundreds of millions of dollars.

However, it's important to note that Saylor's net worth is not purely about the dollar amount. His investment strategy is focused on the long-term preservation of wealth, rather than short-term gains.

By embracing Bitcoin as a strategic reserve asset, he aims to protect his and his company's wealth against potential economic uncertainties.

Citizenship and Residency: An American with a Global Vision

Michael Saylor is an American citizen, and his business activities are primarily based in the United States. MicroStrategy, headquartered in Tysons Corner, Virginia, operates under U.S. regulations, and Saylor’s public advocacy for Bitcoin often focuses on its implications for both U.S. financial systems and the global economy.

CITIZENSHIP AND WEALTH@saylor: “The seventh way to wealth is through citizenship.

— Alex Recouso (@alexrecouso) May 30, 2025

Choose your economic nexus.

Domicile where sovereignty respects your freedom.

Think deeply.

It’s not about this year.

It’s about this century.

Where are you and your family going to be… pic.twitter.com/R4HYqKN25E

While there’s no public indication that Saylor holds any other citizenships, his global perspective is evident in how he views Bitcoin.

Saylor frequently discusses the impact of Bitcoin on international finance, emphasizing its ability to provide a decentralized, borderless store of value. This perspective aligns with his broader vision of Bitcoin as an asset that transcends national borders and monetary policies.

Saylor's approach to Bitcoin and finance reflects an American entrepreneur's mindset, embracing innovation, risk-taking, and the pursuit of long-term strategic advantages. His advocacy for Bitcoin in the U.S. has also sparked discussions about cryptocurrency regulations, taxation, and its role in the country's economic future.

Learn more about citizenship by investment

Early Life and Education: The Makings of an Innovator

Born on February 4, 1965, in Lincoln, Nebraska, Michael Saylor spent most of his childhood as a military brat, moving frequently due to his father's career in the Air Force.

This nomadic lifestyle exposed Saylor to diverse cultures and environments, which likely contributed to his broad vision and innovative mindset.

Saylor attended the Massachusetts Institute of Technology (MIT) on an Air Force ROTC scholarship, where he earned dual degrees in aeronautics and astronautics, as well as science, technology, and society.

During his time at MIT, he developed a keen interest in the power of technology and its potential to transform industries.

After graduating, Saylor worked briefly in consulting before taking a bold step to start his own company. His academic background and technical prowess set the stage for his future success in the tech industry and eventually, his foray into the world of cryptocurrency.

Founding MicroStrategy: A Pioneer in Business Intelligence

In 1989, Michael Saylor co-founded MicroStrategy, a company focused on business intelligence, data analytics, and software solutions.

With Saylor at the helm as CEO, MicroStrategy grew rapidly by helping companies leverage data for strategic decision-making. The company went public in 1998, and by the turn of the century, it was a leader in the business intelligence sector.

MicroStrategy's success stemmed from its ability to provide advanced software tools for data analysis, allowing businesses to uncover insights and trends within their vast data sets. Under Saylor's leadership, the company developed a reputation for innovation, constantly pushing the boundaries of what was possible in business analytics.

However, Saylor was not content with merely staying at the forefront of data analytics. In 2020, he made a dramatic pivot that would redefine MicroStrategy's future and change the narrative of corporate finance forever.

The Bitcoin Bet: MicroStrategy’s Bold Move

In August 2020, Saylor announced that MicroStrategy would adopt Bitcoin as its primary treasury reserve asset.

At a time when many corporations were sitting on large cash reserves amid economic uncertainty, Saylor viewed Bitcoin as a hedge against inflation and the risks of traditional fiat currencies. His conviction was clear: Bitcoin, with its capped supply and decentralized nature, represented a store of value far superior to cash.

MicroStrategy's initial investment in Bitcoin was approximately $250 million. This was followed by a series of additional purchases, bringing the company's total Bitcoin holdings to over 140,000 BTC by 2023.

The company's bold move made headlines, and Saylor became a vocal advocate for Bitcoin, encouraging other corporations and institutional investors to consider it as part of their financial strategies.

Saylor’s decision was based on extensive research and a deep understanding of Bitcoin's fundamentals. He often describes Bitcoin as "digital gold" and views it as a reliable store of value in an era of rampant money printing and inflation.

Saylor's actions set a precedent, prompting other companies like Tesla and Square to explore Bitcoin as a treasury asset.

Expanding Bitcoin Advocacy: Educating the Corporate World

Following MicroStrategy's foray into Bitcoin, Michael Saylor embarked on a mission to educate the corporate world about the benefits of holding Bitcoin.

He hosted a series of events called "Bitcoin for Corporations," providing resources and guidance on how to navigate the complexities of acquiring, storing, and accounting for Bitcoin.

Saylor's advocacy didn't stop at his company. He openly shares his thoughts on Bitcoin across social media platforms and regularly participates in interviews, conferences, and podcasts to discuss the potential of cryptocurrency.

His enthusiasm and commitment have made him a leading figure in the Bitcoin community, with a strong influence on how traditional finance views digital assets.

Beyond just talking about Bitcoin, Saylor also launched the Saylor Academy, a non-profit educational platform that offers free online courses on various subjects, including Bitcoin and blockchain technology.

This initiative reflects his belief that understanding digital assets is crucial for both individual and corporate success in the new financial landscape.

Saylor’s Vision: A Decentralized Financial Future

Michael Saylor's investment in Bitcoin is not just a financial strategy; it's a belief in a decentralized future where individuals and corporations have more control over their assets.

He often refers to Bitcoin as a form of "monetary energy" that can be stored, moved, and utilized across the globe without reliance on traditional banks or government-issued currencies.

Saylor has criticized the current fiat currency system, particularly the way central banks print money, which he believes leads to inflation and devaluation of wealth. In contrast, he views Bitcoin’s fixed supply and decentralized nature as a remedy to these economic challenges.

Through his actions and public statements, he has become a proponent of Bitcoin as a means to achieve financial freedom and sovereignty.

His vision also extends to how corporations should manage their treasuries. He argues that companies holding large cash reserves are vulnerable to inflation and economic instability. By converting cash into Bitcoin, Saylor believes companies can protect and grow their assets over the long term.

Challenges and Criticisms: Navigating a Volatile Market

Saylor's aggressive stance on Bitcoin has not been without controversy. Critics argue that investing a substantial portion of a publicly traded company's assets into a volatile cryptocurrency is risky and could expose shareholders to significant losses.

During periods when Bitcoin's price plummets, MicroStrategy's stock has faced similar declines, leading to questions about the company’s financial strategy.

Saylor, however, remains unfazed by short-term market fluctuations. He maintains that Bitcoin is a long-term investment and that its volatility is a natural part of its growth trajectory.

His belief in Bitcoin's eventual global adoption and dominance as a store of value drives his unwavering commitment to holding the asset, regardless of market conditions.

Conclusion

Michael Saylor has become one of Bitcoin's most vocal and influential champions in the corporate world. His journey from tech entrepreneur to crypto advocate demonstrates a deep understanding of technology, finance, and the potential of decentralized assets.

Through his bold moves with MicroStrategy and his personal investments, Saylor has positioned himself as a key figure in the Bitcoin narrative.

As an American citizen, Saylor operates within the framework of U.S. regulations while promoting a global vision for finance. His emphasis on Bitcoin as a store of value and hedge against inflation resonates with individuals and corporations seeking financial stability in an uncertain economic environment.

Michael Saylor's story is far from over. As he continues to advocate for Bitcoin and educate others on its potential, he remains at the forefront of the ongoing shift towards a decentralized financial future.